Compliance Alert: IRS Raises HSA/HDHP Limits for 2020

Compliance Alert: IRS Raises HSA/HDHP limits for 2020

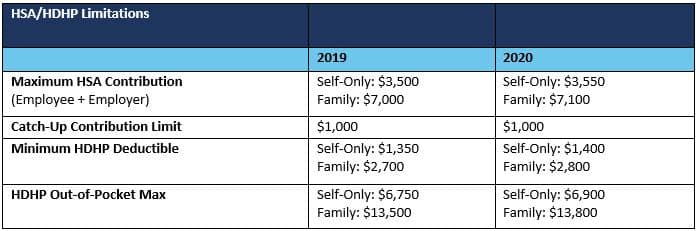

The IRS has announced that effective January 1, 2020, an individual in a High Deductible Health Plan (“HDHP”) with self-only coverage has a new maximum allowable annual contribution into a Health Savings Account of $3,550 , increased from $3,500. The maximum annual contribution for individuals with family coverage will increase from $7,000 to $7,100. The catch-up contribution for people age 55+ remains at $1,000.

See below for the updates to the annual contributions and cost sharing.

Because of the cost-sharing limits change for HDHPs in 2020, employers that sponsor High Deductible Health Plans may need to make plan design changes for plan years beginning in 2020. Employers that allow employees to make pre-tax HSA contributions should review their benefit guides and election forms to reflect the updated HSA contributions limits for 2020.

Categories

Archive