What’s Your Secure Act 2.0 Game Plan?

The Secure 2.0 Act

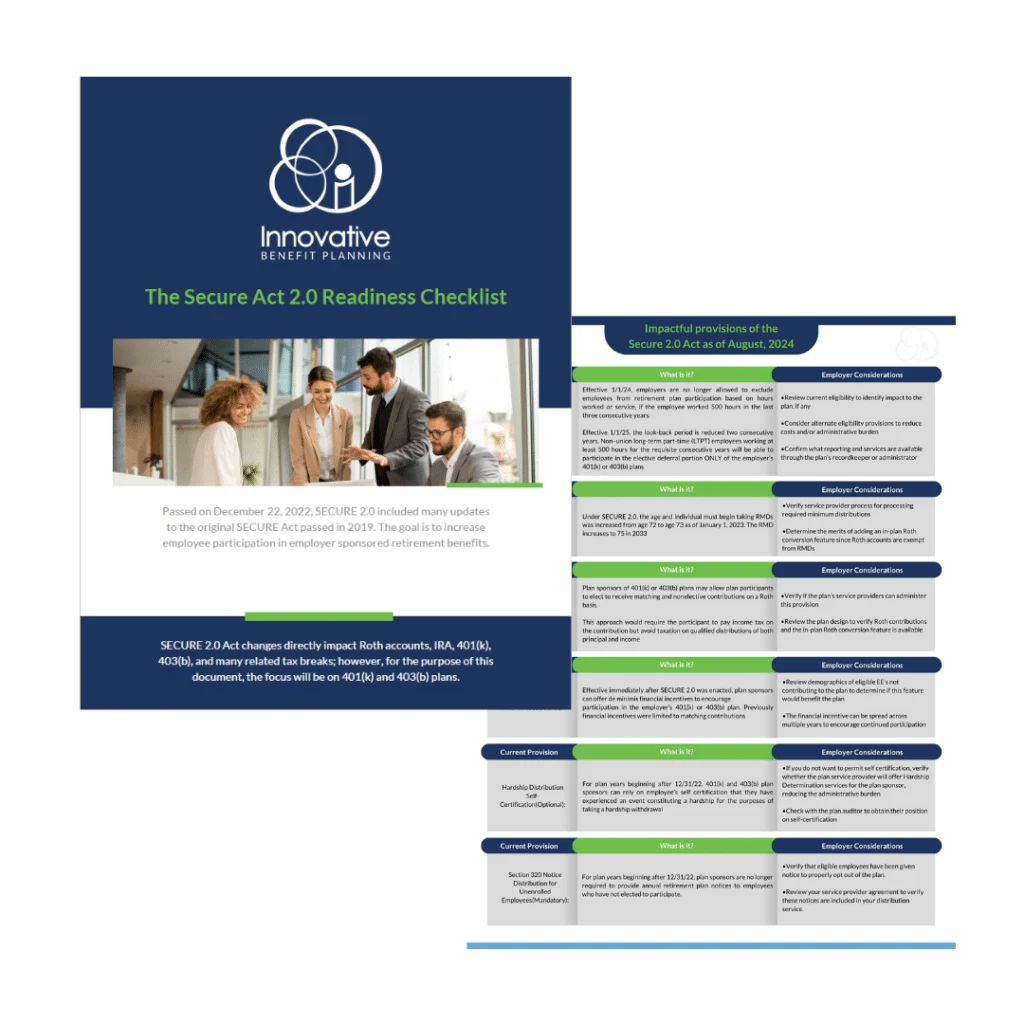

Passed on December 22nd, 2022 the Secure Act 2.0 included many updates to the original Secure Act passed in 2019. The goal was to increase employee participation in employer sponsored retirement plans and align the operational aspects of the various types of plans in the marketplace. The Act contains 90 individual sections with most of them outlining the mandatory and optional provisions impacting employer sponsored 401(k) and 403(b) plans. Some of the provisions became effective in 2023 while others will be effective in the coming years. All plan documents must be amended by 12/31/2026 to reflect these changes.

The changes required to implement the new Secure Act 2.0 provisions are quickly being adopted by 401K providers.

-

Which ones will add value to your organization and should be considered?

-

Which ones should you ignore?

-

Does your organization and 401K provider have the capabilities to effectively administer a new provision?

To get a better understanding of how the Secure Act 2.0 impacts your organization, download our checklist for guidance.

Request Your Complimentary Plan Analysis

Some of the more notable provisions that plan sponsors should review include:

- Changes to the required minimum distribution rules

- Plan Sponsors now have the option to allow for matching and nonelective contributions to be made on a Roth basis.

- Offering De Minimus financial incentives up to $250 to encourage participation in an employer-sponsored retirement plan.

- Plan sponsors can add emergency savings to their plans.

- Making an employer match to the plan based on employee student loan payments.

- Offering emergency savings accounts to employees that will enable them to access plan funds without penalty.

- For individuals meeting a specific salary threshold, catch-up contributions will have to be made on a Roth basis.

- Long-term part-time employees who meet certain criteria must be allowed to defer into the plan.

- Plan sponsors cannot rely on employee’s self certification that they have experienced an event constituting a hardship for the purposes of taking a hardship withdrawal.

- Individuals meeting their salary threshold who are eligible for catch-up contributions.

Plan sponsors need to review their plan design, demographic data and discrimination testing to determine how the many features of the Secure Act 2.0 will impact their organization.