Customized Solutions, Coupled with Caring Support

As an independent, fee-based Registered Investment Advisory firm, we’ve pledged to work on behalf of our clients with no bias toward any investment product or provider. Our talented team of financial professionals works closely with plan sponsors to understand your requirements, identify and measure all options, and secure the highest quality offerings for your organization and employees. Together, we’ll reveal the hidden costs and challenges in your retirement benefits program and ensure a better solution for your employees.

Retirement Plans Made Simple.

What It’s Like Working with Us

Handling your organization’s retirement plan without outside help means learning something new every step of the way. This means time and money is spent by your team addressing retirement plan challenges that Innovative can solve with a single call.

Innovative redefines the way organizations prepare and structure their plans, guiding you to build your plans with a goal. Don’t become overwhelmed with compliance requirements, regulatory issues, vendor selection, and any other complications that might come your way. Big or small, we are here to solve it all.

- Any Problem, Any Time: Managing your plan may involve many new challenges for your team. No matter what they might be, Innovative is here to help. From plan design consulting to fiduciary management, to vendor selection and investment monitoring, and more.

- Employee Education: For best results, your employees need to understand their retirement plan completely. We ensure this through educational seminars, newsletters, and other interactive employee engagement methods to get everyone up to speed and keep them there.

- Seamless Integration: Your plan must be shaped around your company and operations. We analyze your current operations and find the optimal ways to integrate plan administration into your existing processes.

What We do to Support Employers

As an organization, how confidently can you say that your current internal operations and your interaction with your record-keeper and other crucial processes are optimized? At Innovative, we find that one of the most common hurdles that companies experience is inefficient integration of internal processes with outside vendors, making services like audits one of the biggest headaches to navigate.

We maximize operational efficiency by helping you design and manage your administration.

- Assistance with Annual Audit: We optimize any inefficient internal processes that might be slowing down your audit, and proactively prepare necessary documentation and more.

- Compliance Confidence: The question of compliance disturbs most plan sponsors. Our experienced eyes keep a lookout for any potential compliance issues that would impact your plan and organization.

- Maximizing Efficiencies: Service providers don’t always share all of their services and competencies. With Innovative expertise, we help uncover opportunities for plan and process improvements, getting the most possible efficiency from your plan management.

What Success Looks Like When You Work With Us

With Innovative, success means certainty. We offer a single point of contact for all your plan needs to make sure you and your employees are getting the most value from their retirement plan.

- Optimizing Results for Employers: Our experience will help you navigate the complicated waters of ERISA, ensuring compliance peace of mind. Combined with our complete management administration, employers can have the confidence to move forward knowing they have the best plan solution.

- Optimizing Results for Employees: With Innovative on your team, your employees will experience the absolute top outcomes for all participants involved, including good investment performance, no refunds for the highly compensated and high participation rate.

- Maximum Value: At Innovative, we specialize in ensuring that you’re getting the maximum benefit and value for the dollars you’re spending in the plan, with minimal disruption.

Helping Employers Deliver a Comprehensive Retirement Plan Solution

ERISA Compliance

ERISA can be complicated and dealing with retirement plan compliance on your own can be a task that is tough to manage. At Innovative, our clients experience the ultimate regulatory guidance, with access to internal and external counsel on issues surrounding plan design, administration, and more. Never fear the possibilities of outdated information and pitfalls you might not realize exist – we’re here to keep you up-to-date on the latest ERISA regulations.

Fiduciary Management

Simply put, we provide you peace of mind. As a fiduciary and a CEFEX certified Investment Advisor, Innovative will assume fiduciary status to the highest level of fiduciary care for the plan investments, plan sponsor, participants and beneficiaries. Innovative will also work with your service providers on an ongoing basis to help manage overall plan operations and monitor compliance procedures.

Employee Communication

Educating your employees on how to take charge of their financial goals is a win for all. After consultation with your leadership team, Innovative will design and manage an education plan for your organization. Our programs typically include group and one-on-one meetings and can be expanded to include financial wellness programs and customized seminars for participants.

Financial Wellness

Employees who are stressed about money or debt often bring that stress into the workplace, impacting your culture and profitability. Through Innovative’s customized financial wellness programs, we work with employers to design, educate and engage employees so they can become financially secure. We work with you to analyze your demographics and custom tailor programs that meet the needs of your employees.

Customized Plan Design

When trying to maximize the value of your retirement plan, a thorough review of your non-discrimination testing is needed to uncover opportunities or pitfalls with the current plan design. Further, with Innovative’s help, you can create a custom designed plan, perfectly fitted for your culture and environment. By analyzing crucial metrics like corporate structure, participant demographics, and corporate goals, we lay down a unique foundation for a retirement plan that will fit no company better than yours.

Mergers & Acquisitions

When two organizations turn into one or one into two, capable hands need to be involved to gauge the impact to your retirement plan. Through our extensive experience, we streamline the complicated process of integrating or separating multiple plans, ensuring that the organizational impact of the merger or the divestiture are fully understood.

Investment Selection & Monitoring

When partnering with Innovative, you gain reliable, expert guidance on assessing your plan’s investment objectives, designing your overall investment structure, developing your investment policy statement, and monitoring and reporting the performance of your investments.

Plan Governance Services

Innovative will advise on the proper governance structure for the plan including the appointment and training of the Investment Committee, the use of outside experts, the need for formal documentation and the procurement of fiduciary insurance. All committee members are considered Fiduciaries under ERISA. As such, Innovative will assist leadership and committee members in understanding their roles and responsibilities as Fiduciaries.

Vendor Search, Management & Oversight

With countless vendor options available, we simplify the process for you. Innovative can partner with your current retirement plan service provider(s) to align necessary processes and procedures. Typical services include the monitoring of your service providers, fee disclosure assessments, benchmarking reports, creating and evaluating requests for proposals or information and ultimately supporting contract negotiation.

Customized Tax Planning

Changes to the tax code can have significant implications for individuals. Amending your benefit formulas under your existing retirement plan may yield significant tax benefits. At Innovative, we have extensive experience designing retirement plans that increase the contributions allocated to owners and key executives, which in turn can generate significant tax benefits.

Related Resources

Check Out Our Upcoming Events!

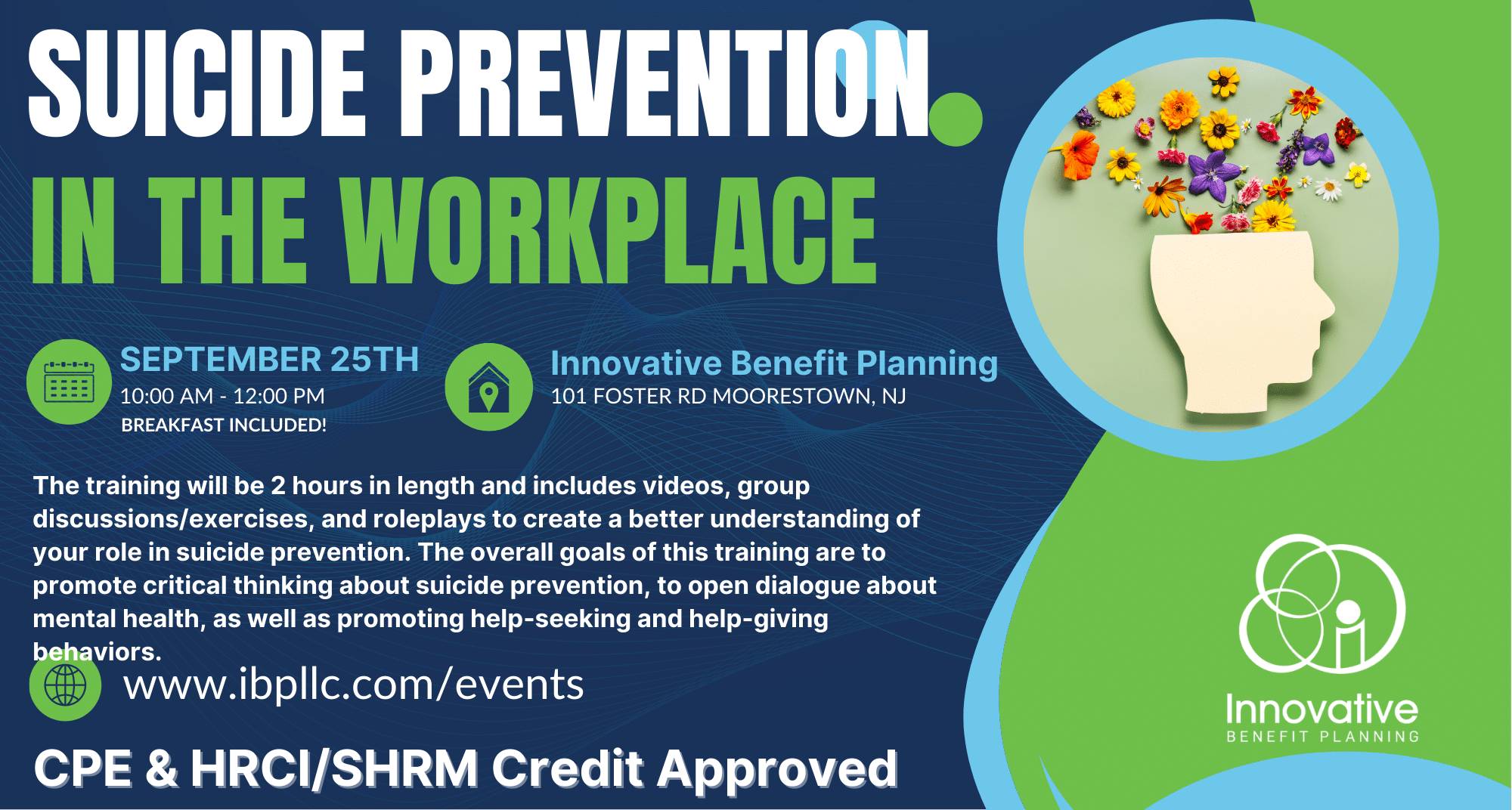

Sep 25

Suicide Prevention Training – September 2025

Innovative Benefit Planning’s Learning Exchange

Free

Find out more