IRS Issues 2022 HSA and HRA Limits

IRS Issues 2022 HSA and HRA Limits

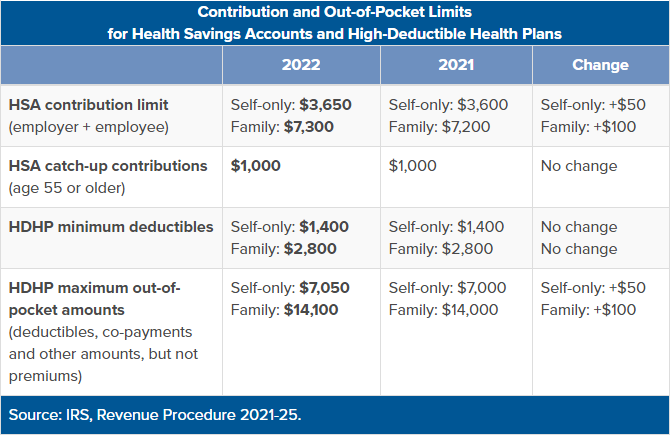

The IRS issued Revenue Procedure 2021-25 on May 10, 2021, to announce the 2022 inflation adjusted amounts for health savings accounts (HSAs) under Section 223 of the Internal Revenue Code (Code) and the maximum amount that may be made newly available for excepted benefit health reimbursement arrangements (HRAs).

HSA Limits

For calendar year 2022, the HSA annual limitation on deductions for an individual with self-only coverage under a high deductible health plan is $3,650. The 2022 HSA annual limitation on deductions for an individual with family coverage under a high deductible health plan is $7,300. The IRS guidance provides that for calendar year 2022, a “high deductible health plan” is defined as a health plan with an annual deductible that is not less than $1,400 for self-only coverage or $2,800 for family coverage, and the annual out-of-pocket expenses (deductibles, copayments, and other amounts, but not premiums) do not exceed $7,050 for self-only coverage or $14,100 for family coverage.

HRA Limits

For plan years beginning in 2022, the maximum amount that may be made newly available for the plan year for an excepted benefit HRA is $1,800. Treasury Regulation §54.9831-1(c)(3)(viii)(B)(1) provides further explanation of the calculation.

To better explain Health Savings Accounts to your employees, check out this informational video.

If you have any questions, please feel free to contact us at info@ibpllc.com.

This Compliance communication is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Categories

Archive