Employee benefits

New Jersey Pay Transparency Act Goes into Effect

As of June 1, 2025, New Jersey employers with 10 or more employees over 20 or more calendar weeks must comply with the New Jersey Pay and Benefit Transparency Act (“NJPBTA”). Covered employers include those doing business, employing individuals, or taking applications for employment within the state. What Does the Law Require?...

Read More

Medicare Creditable Coverage Disclosure Due to CMS by March 1, 2024

The Medicare Modernization Act (MMA) established annual notification requirements for employer-sponsored group health plans with prescription drug coverage. Per the MMA, employers sponsoring these plans are required to disclose annually the creditable status of the plan to The Centers for Medicare and Medicaid Services (CMS). This disclosure is due to...

Read More

7 Low-Cost Initiatives Employers Can Incorporate in Their D&I Programs Now

Countless studies show that employers who focus on diversity and inclusion policies and practices help increase employee engagement and boost overall happiness in the workplace, thus improving retention. Research shows that companies with diverse, inclusive teams generate 19% more revenue and perform 35% better than their industry average. While integrating...

Read More

Are You Leveraging Population Health Management Correctly to Mitigate Claims Risk?

While all health plans face the possibility of higher claims, properly managing your employee’s risk pool and population health can help mitigate claims risk and reduce costs in your plan. Population health management identifies, evaluates, and manages the risks facing an organization and its plan participants. While employers cannot prevent...

Read More

Four Steps to Create a Stable Renewal Environment

Large renewal rate increases frustrate employers and plan sponsors each year. They might experience significant, double-digit rate hikes one year; a smaller uptick the second; and another large increase the third year. Owners, CFOs, and HR executives would prefer stable, predictable trends so they can better budget for future costs....

Read More

How to Reset & Reflect After Benefits Renewal Season

The hectic benefits renewal season is finally winding down for many employers, with open enrollment meetings and all the logistical challenges and decisions behind us for 2021. We’re ready to relax and move on to new challenges during the new year. But wait a second: maybe we shouldn’t put renewal season...

Read More

Government Distribution of Free at-home COVID-19 tests

Starting January 19th, 2022, Americans will be able to order a test online at COVIDTests.gov. To ensure broad access, the program will limit the number of tests sent to each residential address to four tests. Tests will usually ship within 7-12 days of ordering. To help distribute the message to...

Read More

How to Reset and Reflect After Benefits Renewal Season

The hectic benefits renewal season is finally winding down for many employers, with open enrollment meetings and all the logistical challenges and decisions behind us for 2021. We’re ready to relax, enjoy the holiday season, and move on to new challenges during the new year. But wait a second: maybe we...

Read More

End of Year Employee Benefits Compliance Checklist

From ACA reporting to new federal regulations, employers are faced with several obligations as they close out the year and begin to plan for 2022. To help comply with your obligations, we have complied a list of important items that apply to employer-sponsored group health plans to either review and/or...

Read More

How We Resolved One Client’s Self-Funding Worries Through Proprietary Confidence Projection

Client Industry: Technology Number of Employees: 240 Service Provided: Statistical risk analysis and probability projections. Challenges Our client had considered transitioning from fully insured to self-funding for several years. Although we projected the change would bring considerable savings, they remained concerned by the risk that the model might not perform...

Read More

IRS Issues 2022 FSA and Commuter Limits

The IRS has announced the 2022 max contribution limits for FSA and Commuter accounts [Revenue Procedure 2021-45]. All FSA and Commuter plans (for the 2022 plan year) will be updated with the 2022 contribution limits. If you have any questions, please contact your account team or email us at icomply@ibpllc.com....

Read More

Innovative Saves Company From a $440,000 Renewal Increase with 45 Days Till Renewal

Challenges A construction company with 100 employees was facing a 29 percent renewal increase for its employee benefits package. The additional cost, which was over $440,000, was much more than the company could absorb. Passing the costs on to the employees through less coverage and higher deductibles seemed like the...

Read More

Employers COVID-19 Vaccine Resources & Kit

Sometimes it’s hard to keep up with all the latest recommendations and regulations. In an effort to ease the burden, we have compiled eight important resources that you can access when planning your COVID-19 vaccine practices. Access Here

Read More

Innovative Launches New Groundbreaking Benefit Performance Assessment

Innovative Launches New Groundbreaking Benefit Performance Assessment Innovative has launched our new groundbreaking, proprietary Benefit Performance Assessment. This complimentary assessment shows employers how they can cut waste, take control of healthcare costs, and provide better service solutions. All within an hour of your time and without impacting the coverage offered...

Read More

3 Reasons Every Employer Should Benchmark Their Health Plan

3 Reasons Every Employer Should Benchmark Their Health Plan As employers are competing for the race for talent and trying to bend the rising health care cost curve, benchmarking employee benefits is more important than ever. Here are three advantages to benchmarking health benefits: Bragging Rights: Employee benefits are a...

Read More

4 Ways to Leverage National Insurance Awareness Day to Increase Employee Awareness and Participation

June 28th is National Insurance Awareness Day! It was created as a day to review your insurance coverage and is also a great time to help your employees understand the benefits that are available to them. Focus today on empowering your employees to better understand, appreciate and participate in their...

Read More

Supreme Court Effectively Upholds ACA in Texas v. United States Ruling

Supreme Court Effectively Upholds ACA in Texas v. United States Ruling On June 17, 2021, the U.S. Supreme Court upheld the constitutionality of the Patient Protection and Affordable Care Act (ACA) by a 7-to-2 vote. The Court heard oral arguments in the case, California v. Texas, on November 10, 2020,...

Read More

4 Ways Digital Open Enrollment Guides Improve Employee Engagement

4 Ways Digital Open Enrollment Guides Improve Employee Engagement Every year open enrollment season allows employees to start, stop, or change their existing health insurance plans. Often, however, open enrollment can be a source of confusion, leaving employees with a lack of understanding and underutilizing their plan. Digital open enrollment...

Read More

BCBSA Antitrust Settlement Classes Eligible for Proceeds

BCBSA Antitrust Settlement Classes Eligible for Proceeds November 5, 2021 is the deadline for filing a claim in connection with the Blue Cross Blue Shield Association (BCBSA) $2.67 billion settlement reached in October 2020. The class action lawsuit was filed more than eight years ago by subscribers seeking injunctive and...

Read More

Why Employers Should Benchmark Their Health Plan Before Renewal

Why Employers Should Benchmark Their Health Plan Before Renewal Benchmarking your health plan during renewal ensures that the benefits being offered continue to be a right fit for the company and employees based on data-driven decisions. On the other hand, a poorly planned renewal done in the dark can cause...

Read More

IRS Issues 2022 HSA and HRA Limits

IRS Issues 2022 HSA and HRA Limits The IRS issued Revenue Procedure 2021-25 on May 10, 2021, to announce the 2022 inflation adjusted amounts for health savings accounts (HSAs) under Section 223 of the Internal Revenue Code (Code) and the maximum amount that may be made newly available for excepted...

Read More

5 Reasons Employers Should Carve Out Prescription Drug Benefits

5 Reasons Employers Should Carve Out Prescription Drug Benefits Prescription Drugs typically makes up 20% of an employer’s overall spend, and with the rise in specialty drugs, industry experts expect that number to encroach 50%. Employers have the ability to “carve-out” this coverage from their medical plan, resulting in significant...

Read More

Innovative Launches New Online Health Plan Benchmarking Tool

Innovative Launches New Online Health Plan Benchmarking Tool Benchmarking is more important than ever. Knowing how your health plan compare to your peers allows you to be competitive in recruiting and retaining the best employees, assist with making data-driven decisions during renewal planning, and see how your health plan costs...

Read More

Innovative Launches New Digital Employee Benefit Guide Technology

Innovative Launches New Digital Employee Benefit Guide Technology As technology continues to transform the workplace, HR professionals are seeking new and improved ways to deliver their health plan benefits, while gaining rich backend intelligence to improve the utilization of the plan. We have the solution! Innovative Benefit Planning is excited...

Read More

Innovative’s 2020 Consulting Highlights

Innovative’s 2020 Consulting Highlights 2020 was a challenging year for many, but here at Innovative, we were dedicated to delivering the best value and results for our clients. Not only were we successful in reducing costs for our clients, but we were able to provide them with a number of...

Read More

Is Level Funding a Good Fit for Your Employee Benefits Plan?

Is Level Funding a Good Fit for Your Employee Benefits Plan? Level funding is a great strategy for employers that are interested in self-funding, but like a plan that looks and feels like it is fully insured. Level funding acts just like a fully insured plan, except it provides the...

Read More

Final Rule on the Extension of Certain Timeframes For Employee Benefit Plans, Participants, and Beneficiaries Due to COVID-19

Final Rule on the Extension of Certain Timeframes For Employee Benefit Plans, Participants, and Beneficiaries Due to COVID-19 The DOL issued EBSA Disaster Relief Notice 2021-01 providing that the outbreak period relief noted below ends on the earlier of one year from the date an individual or plan was first...

Read More

Incorporating Wellness into Your Employee Benefits Strategy

Incorporating Wellness into Your Employee Benefits Strategy Wellness is a strategy that continues to gain in popularity as employers are looking for ways to help their employees become healthier, more engaged, and happier at work. Wellness is typically broken into three categories. The first category is educational wellness. With an...

Read More

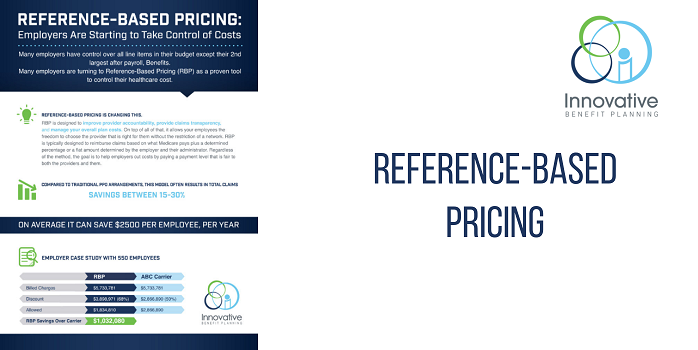

Reference Based Pricing

Reference Based Pricing With healthcare costs skyrocketing at unsustainable levels, employers are considering nontraditional methods of funding their medical plans. One nontraditional method that employers are starting to consider is called reference based pricing, or RBR. This method has proven to reduce overall benefit spend 20 to 30%, when compared...

Read More

What is Bundled Pricing?

What is Bundled Pricing? Many employers are frustrated with a lack of financial and quality transparency in the healthcare marketplace. As such, many employers have considered offering a bundled pricing solution to their employees. Bundled pricing is a unique solution that provides employees the opportunity to shop for a procedure...

Read More

Understanding Captives and Consortiums

Understanding Captives and Consortiums As health insurance costs continue to rise, many small and mid-size employers have looked for ways to alternatively fund their plans and potentially save costs. Self-funding can be daunting and unmanageable for many small to mid-size employers, but there are many self-funding options to consider. Captives...

Read More

December Compliance Recap

December was a busy month in the employee benefits world. President Trump signed the Consolidated Appropriations Act, 2021, which includes the No Surprises Act and other group health plan provisions. The Centers for Disease Control Advisory Committee on Immunization Practices (ACIP) issued two interim recommendations for COVID-19 vaccines. The Department...

Read More

Mandatory Coverage of COVID-19 Vaccines under Group Health Plans

Mandatory Coverage of COVID-19 Vaccines Under Group Health Plans On December 11, 2020, the Food and Drug Administration (FDA) issued an Emergency Use Authorization for the Pfizer-BioNTech COVID-19 vaccine (Pfizer vaccine). The following day, December 12, 2020, the Centers for Disease Control Advisory Committee on Immunization Practices (ACIP) issued an...

Read More

November Compliance Recap

November Compliance Recap November was a relatively busy month in the employee benefits world. The U.S. Supreme Court (Supreme Court) heard oral arguments in the case of California v. Texas, which is the case challenging the constitutionality of the ACA. The Internal Revenue Service (IRS) released the updated Patient-Centered Outcomes...

Read More

Partially Self-Funded Plans with an HRA

Partially Self-Funded Plans with an HRA As health insurance costs continue to rise, more and more small and mid-size employers are looking for ways to take control of their healthcare costs. A health reimbursement account, or an HRA, is a way in which employers can step into self-funding and start...

Read More

Understanding Key Health Insurance Terms

Understanding Key Health Insurance Terms The language of health insurance can be confusing but understanding some key terms will help your employees comprehend the basics of your organization’s plan, allowing them to make smart decisions that will benefit their family. Rather than feeling confused, encourage them to review the following...

Read More

Final Rules on Coverage Transparency

Final Rules on Coverage Transparency On October 29, 2020, the Internal Revenue Service (IRS), Department of Labor (DOL), and the Department of Health and Human Services (HHS) (collectively, Departments), released final rules on coverage transparency, in order to provide health coverage recipients with an estimate of their potential cost-sharing liability...

Read More

6 Self-Funding Strategies to Suit Your Needs

6 Self-Funding Strategies Self-funding is nothing new as it has been a common form of health plan financing since 1974. Self-funding provides great flexibility with plan designs and provides freedom from most state laws. In fact, over 60% of US employees are covered under a self-insured medical plan. Under self-funded...

Read More

3 ACA Reporting Errors and The Pandemic’s Impact

3 ACA Reporting Errors and The Pandemic’s Impact As we approach the end of 2020, we must consider how the various enrollment fluctuations due to the COVID-19 Pandemic will impact the ACA Employer Mandate and the already tedious 1095/1094 ACA Reporting. The IRS recently granted a March 2nd deadline extension...

Read More

Have You Received an MLR Rebate Check? What To Do Next?

Have You Received an MLR Rebate Check? What To Do Next? The Affordable Care Act requires health insurance carriers to spend at least 80-85 percent of premium dollars on medical care and healthcare quality improvement. If the carrier does not meet this medical loss ratio (MLR) obligation, it must give...

Read More

August Compliance Recap

August 2020 Compliance Recap August was a relatively busy month in the employee benefits world. The Congressional Research Service (CRS) released an updated report on health savings accounts (HSAs) that summarizes the principal rules governing HSAs and changes made to HSAs as a result of the COVID-19 pandemic. The Department...

Read More

July Compliance Recap

July was a busy month in the employee benefits world. The U.S. Supreme Court (Supreme Court) upheld the religious exemption and moral exemption final rules to the Patient Protection and Affordable Care Act (ACA) contraceptive mandate. The Internal Revenue Service (IRS) released the indexed 2021 ACA affordability percentage. The President...

Read More

June Compliance Recap

June was a busy month in the employee benefits world. The Internal Revenue Service (IRS) released the updated patient-centered outcomes research institute (PCORI) fee amount and announced transition relief. The Department of Health and Human Services’ Office for Civil Rights (OCR) published a final rule regarding the Patient Protection and...

Read More

Judge Rules for HHS in Price Transparency Case

Judge Rules for HHS in Price Transparency Case A federal judge ruled against the American Hospital Association (AHA) on Tuesday in its lawsuit attempting to block an HHS rule pushing for price transparency. The judge ruled in favor of the department, which requires hospitals to reveal private, negotiated rates with insurers beginning...

Read More

HSA Limits Released for 2021

IRS issued the 2021 cost-of-living adjustments for Health Savings Accounts and High Deductible Health Plans. 2020 2021 Self-Only Contribution Limit $3,550 $3,600 Family Contribution Limit $7,100 $7,200 HDHP – self-only coverage Annual deductible not less than: Annual out-of-pocket expenses do not exceed: $1,400 $1,400...

Read More

Open Enrollment and Outcomes Based Health Screenings Options During COVID-19

Open Enrollment and Outcomes Based Health Screenings Options During COVID-19 Due to the COVID-19 outbreak, employers who were planning on offering on-site health screenings tied to payroll deductions are unfortunately being forced to consider other options. Thankfully, the screening vendors have been flexible with delaying screening dates. As an employer,...

Read More

Final Rule on the Extension of Certain Timeframes for Employee Benefit Plans Due to COVID-19

On March 13, 2020, President Trump issued the Proclamation on Declaring a National Emergency Concerning the Novel Coronavirus Disease (COVID-19) Outbreak and by separate letter made a determination, under Section 501(b) of the Robert T. Stafford Disaster Relief and Emergency Assistance Act, that a national emergency exists nationwide beginning March...

Read More

Paycheck Protection Program and Health Care Enhancement Act

Paycheck Protection Program and Health Care Enhancement Act In response to the spread of the 2019 novel coronavirus (COVID-19), President Trump signed the Paycheck Protection Program and Health Care Enhancement Act (PPPHCEA) into law on April 24, 2020. The PPPHCEA is phase 3.5 in Congress’ response to the COVID-19 pandemic...

Read More

Relaxed Life, Disability and Long-Term Care Insurance Underwriting

As a result of the COVID-19 National Emergency, insurance companies have adapted to help individuals easily secure protection and obtain insurance without a medical exam that requires a nurse to visit your home or office. This is a TEMPORARY change that will likely end when social distancing can stop. How...

Read More

March Compliance Recap

March was a busy month in the employee benefits world. The President signed the Families First Coronavirus Response Act (FFCRA) into law. The Department of Labor (DOL) issued a bulletin regarding enforcement of the FFCRA. The President also signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) into...

Read More

Gov. Murphy Signs Executive Order Granting Grace Periods for Insurance Premium Payments

Gov. Murphy Signs Executive Order Granting Grace Periods for Insurance Premium Payments On April 9, 2020, New Jersey Governor Phil Murphy signed Executive Order No. 123, extending grace periods during which certain insurance companies, including health and dental insurers, life insurers, and property and casualty insurers, will not be able to...

Read More

COVID-19 Employer Considerations Regarding Employment Decisions and Plan Coverage Changes

Due to the recent national health crisis in our country, many employers are considering the best way to handle a temporary economic turndown to best position themselves for recovery once the pandemic ceases and businesses can begin to return to some sense of normalcy. In addition, many employers are also...

Read More

CARES Act: Impact on Employee Benefits

CARES Act: Impact on Employee Benefits On March 27, 2020, Congress passed, and the President signed, an unprecedented 2 trillion-dollar stimulus and relief package into law, named the Coronavirus Aid, Relief, and Economic Security Act or the CARES Act. This act provides direct stimulus relief to corporations and individuals. While...

Read More

Telemedicine Wait Times

In light of the recent COVID-19 (coronavirus) outbreak. The CDC recommends leveraging telemedicine for your unique medical needs to help limit the spread of the virus by eliminating the risk of exposure to the ER, urgent care, and primary care offices. They are recommending members schedule their virtual visits rather...

Read More

COVID-19: Carrier Enhancements

COVID-19: Carrier Enhancements March 17th, 2020 Due to the outbreak of COVID-19 in the United States, the CEO’s of major US health insurance companies met at the White House on March 10, 2020 and agreed to waive costs for certain services such as the COVID-19 test, telemedicine services and prescription...

Read More

Ways Employers Can Deal With Employee Student Loan Debt

Ways Employers Can Deal With Employee Student Loan Debt February 25th, 2020 Student debt has increased dramatically in recent years, creating a financial burden on employees’ ability to save for retirement. Many employers have begun implementing programs to help employees manage student loan debt. Millennials (and their families) are often...

Read More

December Compliance Recap

December was a busy month in the employee benefits world. The U.S. Court of Appeals for the Fifth Circuit held that the Patient Protection and Affordable Care Act’s (ACA’s) individual mandate is unconstitutional. The Internal Revenue Service (IRS) released final instructions and final 1094-B, 1095-B, 1094-C, and 1095-C forms for...

Read More

The ACA’s Cadillac, HIT and Medical Device Taxes Are Repealed; PCORI Fee Extended for 10 More Years

On December 20, 2019, the President signed a $1.4 trillion spending bill that will fund the federal government through September 30, 2020. The bill signed by the President specifically includes the repeal of three major taxes that fund the Affordable Care Act (ACA), including the “Cadillac” tax, the health insurance...

Read More

IRS Extends ACA Reporting Deadline for Furnishing Statements for 2019 from January 31 to March 2, 2020

In Notice 2019-63, the IRS extended the 2020 deadline for employers and insurers to furnish individual statements on 2019 health coverage and full-time employee status (Forms 1095-B and 1095-C) from January 31 to March 2. The notice also extends the good-faith penalty relief to 2019 for incorrect or incomplete reports due in 2020....

Read More

2020 IRS Contribution Limits Released

On Wednesday, the IRS announced new contribution limits for medical FSA, Commuter Benefit, and HSA plans for 2020. The FSA contribution will increase to $2,750, a $50 increase from current limits. The HSA contribution limit for individuals with a high deductible health plan (HDHP) will likewise be raised from $3,500...

Read More

September 2019 Compliance Recap

September was a busy month in the employee benefits world. The U.S. Senate confirmed Eugene Scalia as the new Secretary of the Department of Labor (DOL). The Internal Revenue Service (IRS) published proposed rules regarding affordability safe harbors and Section 105(h) nondiscrimination rules as applied to individual coverage health reimbursement...

Read More

Innovative Benefit Planning Named “Best of Biz 2019”

Innovative Benefit Planning has been named by South Jersey Biz, as one of their 2019 Best of Biz recipients. The Best of Biz award recognizes 102 of region’s most esteemed service providers and we are proud to say that Innovative has been selected for their “Employee Benefits” category. According to...

Read More

Additional Preventive Care Benefits Permitted for High Deductible Plans

In Executive Order 13877, issued June 2019, the Treasury Department and the IRS were directed to consider ways to expand the use and flexibility of HSA’s and HDHP’s. In response to the Executive Order, the Treasury Department issued guidance on July 17, 2019, that lists newly identified preventive care items...

Read More

Pennsylvania Medical Marijuana Updates

Effective July 20, 2019, Pennsylvania will recognize anxiety and Tourette Syndrome as serious medical conditions in the medical marijuana program. The Pennsylvania Department of Health stated that the decision came after a research-based recommendation by the state’s Medical Marijuana Advisory Board, followed by Health Secretary Rachel Levine ’s careful review of the...

Read More

HRA Final Rules

The Department of the Treasury (Treasury), Department of Labor (DOL), and Department of Health and Human Services (HHS) (collectively, the Departments) recently released their final rules regarding health reimbursement arrangements (HRAs) and other account-based group health plans. An HRA is a type of account-based group health plan funded solely by...

Read More

EEOC Component 2 Data Update

On July 2, 2019, following initial notifications to employers of the upcoming Component 2 filing deadline, the EEOC updated the Component 2 website to include both Additional Information https://eeoccomp2.norc.org/info.html and Frequently Asked Questions (FAQs) sections. https://eeoccomp2.norc.org/faq.html Under the Additional Information section, employers can find a sample form, an instruction booklet,...

Read More

Reference-Based Pricing: Employers Are Starting to Take Control of Costs

You may have heard of Reference-Based Pricing as the healthcare strategy gains momentum to control healthcare costs. But what is it and how does it work? Click below to learn what Reference-Based Pricing is and the pros and cons to consider. Innovative’s unique Reference-Based Pricing 6 step process first makes...

Read More

NJ Now Has Greater Protections for Employees Who Are Cannabis Users

On July 2, 2019, New Jersey Governor Phil Murphy signed a bill into effect that overhauls the state’s existing medical cannabis program and law, the Compassionate Use of Medical Marijuana Act (CUMMA), and greatly expands patient access to medical marijuana. For employers who must address the issue of employees and...

Read More

HHS Proposes to Revise ACA Section 1557 Rule

On May 24, 2019, the Department of Health and Human Services’ Office for Civil Rights (OCR) released a proposed rule to revise its regulations under the Patient Protection and Affordable Care Act’s Section 1557. OCR also released a fact sheet and press release. The proposed rule would eliminate: Certain definitions,...

Read More

May 2019 Compliance Recap

May was a busy month in the employee benefits world. The Internal Revenue Service (IRS) released health savings account annual contribution limits and high deductible health plan minimum annual deductibles and annual out-of-pocket maximums for 2020. The Department of Labor (DOL) released questions and answers (Q&As) to clarify its enforcement...

Read More

EEOC Pay Data Collection

The Equal Employment Opportunity Commission (“EEOC”) announced that it will collect information from applicable employers on employee pay and hours-worked—known as Component 2 data—for 2017 and 2018 as part of the annual EEO-1 report and the data is due by September 30, 2019. The Department of Justice filed a Notice...

Read More

Compliance Alert: IRS Raises HSA/HDHP Limits for 2020

Compliance Alert: IRS Raises HSA/HDHP limits for 2020 The IRS has announced that effective January 1, 2020, an individual in a High Deductible Health Plan (“HDHP”) with self-only coverage has a new maximum allowable annual contribution into a Health Savings Account of $3,550 , increased from $3,500. The maximum annual...

Read More

April 2019 Compliance Recap

April was a busy month in the employee benefits world. The Centers for Medicare & Medicare Services (CMS) issued its parameters for the defined standard Medicare Part D prescription drug benefit for 2020. In the court case challenging the Patient Protection and Affordable Care Act’s constitutionality, the court will hear...

Read More

New NJ Commuter Law

Governor Murphy signed a new law on March 1, 2019, read here: Commuter Law, requiring certain employers to provide pre-tax commuter fringe benefits to employees. New Jersey employers with at least 20 employees in the state will need to begin offering those employees pre-tax transportation fringe benefits covering commuter highway vehicle...

Read More

March 2019 Compliance Recap

March was a busy month in the employee benefits world. The Department of Justice (DOJ) announced that it will not defend the Patient Protection and Affordable Care Act (ACA) in the court case challenging the ACA’s constitutionality. The Internal Revenue Service (IRS) updated two Q&As regarding ACA reporting for 2018....

Read More

Action-Based Wellness-How it Can Reduce Claims Cost 10-25%

See how Innovative helped one client save significant claims dollars over a three year period by implementing a “results-based” wellness program. During the three year period, Innovative was able to help our client: Obtain 96% of employees to participate in Biometric Screenings Implement a proactive outreach incentive program 60% of employees to improve or remain low...

Read More

Recent Updates in New Jersey Law

A lot has been happening in New Jersey since the new year began, and there have been a few critical updates for New Jersey employers and employees. New Jersey Minimum Wage On January 17, 2019, Governor Phil Murphy and legislative leaders agreed on legislation that will incrementally increase New Jersey’s...

Read More

Innovative Attends NAHU Capitol Conference

February 24-27th, Vice President Consulting Ryan Kastner, Director of Marketing Jamie Bratton and Vice President of HR & General Counsel, Deirdre Groenen, Esq. attended the 2019 NAHU Capitol Conference in Washington, DC. During their time in Washington, the trio attended three days of informative sessions that detailed changing legislation that...

Read More

December Compliance Recap

December was a relatively quiet month in the employee benefits world. A U.S. District Court issued an order declaring that the Patient Protection and Affordable Care Act (ACA) is unconstitutional. The Equal Employment Opportunity Commission (EEOC) issued two final rules to remove certain wellness program incentives. The Department of Labor...

Read More

10 FAQs Regarding The New Jersey Paid Sick Leave Act

1.) Earned sick leave may be used for: The treatment, care or diagnosis for employee or family member Employee or family member a victim of domestic or sexual violence (*has no 25 employees + or 1,000 hours worked requirement like the NJ Safe Act). Workplace or school/daycare closed by a public...

Read More

The IRS Increases the PCORI Fee

The Internal Revenue Service announced that the Patient-Centered Outcomes Research Institute (PCORI) fee will rise to $2.45 (from $2.39) per covered life in plan years that fall between October 1, 2018, and September 30, 2019. This increase will have an impact on 2019 plan year rates and is attributable to...

Read More

Tax Credit Check from Horizon

Attention Horizon customers! You may have received or will receive shortly, a check in the mail from Horizon regarding a tax credit refund check. Note, this is a legitimate check and you can use these funds however you see fit. Why are you receiving this check? In late 2017, the...

Read More

ACA Extensions Announced

Yesterday afternoon, the IRS released Notice 2018-94, which announced an extension of the 2019 deadline for insurers and employers to furnish forms 1095-B and 1095-C to individuals. These forms, originally due January 31, 2019 are now due March 4, 2019. Although the furnishing deadline has been extended, the IRS has...

Read More

Innovative Compliance- The New Jersey Equal Pay Act

As of July 1, 2018, the Diane B. Allen Equal Pay Act (“the Act”), which amends the New Jersey Law Against Discrimination (“LAD”), went into effect in New Jersey. The Act applies to all New Jersey public and private employers regardless of size, except federal employers. https://www.njleg.state.nj.us/2018/Bills/S0500/104_R2.PDF Pursuant to the...

Read More

New Tri-Agency Proposed Rule on Health Reimbursement Arrangements

The Department of the Treasury (Treasury), Department of Labor (DOL), and Department of Health and Human Services (HHS) (collectively, the Departments) released their proposed rule regarding health reimbursement arrangements (HRAs) and other account-based group health plans. The DOL also issued a news release and fact sheet on the proposed rule....

Read More

Important NJ Earned Sick Leave Update

In yesterday’s blog post, we discussed the New Jersey Earned Sick Leave Law, which went into effect this Monday, October 29th. For more on the specifics of the law. In addition to the employer obligations outlined in the previous post, all employers with employees working in New Jersey must post...

Read More

NJ Earned Sick Leave Law Goes into Effect

For New Jersey employers (or PA, NY or other employers who have employees who work in NJ), the NJ Earned Sick Leave Law went into effect Monday, October 29, 2018. Below is a link to a very comprehensive list of FAQs on the law, but here are some highlights: There...

Read More

Student Loan Considerations for Plan Sponsors-Part Two

As a follow up to our first article on student loan debt, its impact on employers and the recent IRS Private Letter Ruling (PLR) regarding student loan repayments, we’ve attached a summary of items to consider when contemplating this type of arrangement. As this ruling has just been released, we...

Read More

Innovative’s Executive Account Manager, Elizabeth Ferroni, attends Annual Employee Benefits Symposium

Our Executive Account Manager, Elizabeth Ferroni, just came back today from attending the Annual ISCEBS Employee Benefits Symposium in Boston, MA. Now in its 37th year, the symposium brings together thousands of benefit professionals to learn, discuss and hear from industry experts and leaders. Elizabeth is excited to be back...

Read More

Innovative Speaks at Leading Age NJ Annual Meeting & Expo

Last Wednesday, the Innovative team had the pleasure exhibiting and presenting at the Leading Age New Jersey Annual Meeting & Expo at Harrah’s Casino in Atlantic City, NJ. Innovative representatives, Dan Foley and Ryan Kastner, presented **Bucking the Trend: _Health Plan Cost Containment Strategies_** to an audience of aging services providers....

Read More

Compliance Alert! – NJ Gov. Phil Murphy Signs Two New Healthcare Acts into Law

This past week, New Jersey Governor, Phil Murphy, signed two bills into law that will impact New Jersey residents. Employers who offer benefits in New Jersey and surrounding states should be mindful of these changes as they will affect employees who reside and/or receive medical treatment in New Jersey. Out-of-network...

Read More

Horizon BCBSNJ Changes Coverage for Brand Name Oral-Combined Contraceptives

Starting June 15, 2018 , Horizon Blue Cross Blue Shield of New Jersey will be making changes to the way brand name oral-combined contraceptives are covered. Previously covered with a $0 copay, brand name oral-combined contraceptives will now be subject to co-payment or coinsurance that corresponds with the member’s pharmacy...

Read More

IRS Releases 2019 Calendar Year HSA Contribution Limits and HDHP Deductible Minimums and Out-of-Pocket Maximums

The IRS has released the maximum contribution limits for Health Savings Accounts (HSAs) and High Deductible Health Plan (HDHP) minimum deductibles and out-of-pocket maximums for the 2019 Calendar Year. For your convenience, we’ve provided a summary below. You can reference the official document here. Health Savings Account contribution limit for...

Read More

New Jersey Paid Sick Leave Act Signed into Law

New Jersey has now become the tenth state to enact a statewide mandatory paid-sick-leave law. The New Jersey Paid Sick Leave Act was signed into law on May 2nd by Gov. Phil Murphy and will go into effect on Oct. 29, 2018. Once effective, it will require New Jersey employers...

Read More

2018 Health Savings Account Contribution Limits Change Once Again

If you recall, after the passing of the tax reform bill, known formally as the Tax Cuts and Jobs Act, the IRS adjusted the amount for HSA family contributions from $6,900 to $6,850 due to a change in inflation calculations. After public outcry and consideration of the administrative and financial...

Read More

New Jersey Newborn Mandate Changes in 2018

In January 2018, the State of New Jersey updated the existing NJ Newborn Mandate that provides health coverage for all newborns from the moment of birth for the first 31 days to provide coverage from the moment of birth for the first 60 days. The newborn child of a subscriber...

Read More

March Compliance Recap

March was a quiet month in the employee benefits world. The Internal Revenue Service (IRS) released a bulletin that lowered the family contribution limit for health savings account (HSA) contributions. The U.S. Department of Labor (DOL) updated its model Premium Assistance Under Medicaid and the Children’s Health Insurance Program notice...

Read More

PrimeMail by Walgreens Gets a New Name

Effective 3/31/2018 PrimeMail by Walgreens Mail Service will operate under the name “Alliance RX Walgreens Prime“. Prime + Walgreens assures customers that only their name is changing. AllianceRX Walgreens Prime promises to stay consistent with their standards for communications, prescriptions, refills and service. Employers who have health plans with Horizon...

Read More

The Importance of Wellness in the Workplace

Workplace Wellness is an investment which works much like any other investment- You put in time and money in hopes of a more valuable outcome, which in this case is the health of your employees, their families and your bottom line. Engagement, motivation, strategy, and support are the keys to...

Read More

IRS RECALCULATES 2018 HSA & EMPLOYER ADOPTION ASSISTANCE PROGRAMS

Yesterday, the Internal Revenue Service (IRS) released a bulletin that includes a change impacting contributions to Health Savings Accounts (HSAs) and Employer Adoption Assistance Programs. The family HSA contribution for 2018 has been reduced from $6,900 to 6,850. This change is effective January 1, 2018. We advise plan participants to...

Read More

Focusing on FMLA

Human Resource professionals are often asked by their employees about taking a leave of absence. Sometimes, these leaves of absences are protected by the federal government. The Family and Medical Leave Act (FMLA) entitles eligible employees of covered employers to take unpaid, job-protected leave for certain medical and family reasons....

Read More

January Compliance Recap

January was a busy month in the employee benefits world. On January 24, 2018, the U.S. Senate confirmed Alex Azar as the new Secretary of the U.S. Department of Health and Human Services (HHS). The U.S. Department of Labor (DOL) proposed regulations regarding association health plans. HHS released the 2018...

Read More

Trump Signs Bill to Delay Cadillac and Health Insurance Taxes

On January 22, 2018, the U.S. Congress voted to pass a bill that would continue to fund the government through February 8, 2018. President Trump signed the bill today, January 23, 2018. In addition to continuing government funding, the bill also includes two legislative victories for employers: delaying the Cadillac...

Read More

IRS Announces Extension for Furnishing 1095-B & 1095-C Forms to Employees

Recently, the Internal Revenue Service announced an extension for employers to provide 1095-B or 1095-C Forms to their employees. The IRS announced a 30-day extension, extending the due date from January 31, 2018 to March 2, 2018. The IRS has not announced an extension for filings to the IRS. Therefore,...

Read More

IRS to Send ACA Penalty Letters

The Internal Revenue Service (IRS) has indicated that it plans to begin notifying employers by year end of their potential liability for failing to provide sufficient health coverage that is compliant with the Patient Protection and Affordable Care Act (ACA). The agency will begin notifying Applicable Large Employers (ALEs) of...

Read More

Innovative Partners with Morey’s Piers & Beachfront Water Parks

Innovative is excited to announce our new partnership with Morey’s Piers & Beachfront Water Parks. Morey’s Piers, located in Wildwood, New Jersey is an iconic seaside amusement park comprised of three amusement piers and two beachfront waterparks beloved by beachgoers far and wide. Innovative has been selected as the Benefit...

Read More

DOL Overtime Rule Defeated in Court, DOL to Appeal

As you may recall, the Department of Labor put forth overtime regulations that would have taken effect last December, enabling 4.2 million employees to be eligible for time and a half wages for every hour worked over the standard 40 hours per week. However, a number of business groups filed...

Read More

IRS Releases Maximum Contribution, Deferral and Compensation Limits for HSA, FSA, and 401(k) for 2018

The IRS has released the maximum contribution limits for Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) for 2018. The IRS also released the maximum deferral and compensation limits for 401(k) accounts. Health Savings Accounts Single Coverage Maximum Contribution Limit: $3,450 ($50 increase from 2017) Family Coverage Maximum Contribution...

Read More

President Trump Ends ACA Cost Sharing Reductions

On the evening of October 12, 2017, President Trump announced that cost sharing reductions for low income Americans in relation to the Patient Protection and Affordable Care Act (ACA) would be stopped. The Department of Health and Human Services (HHS) has confirmed that payments will be stopped immediately. It is...

Read More

Compliance Alert!

Two tri-agency (Internal Revenue Service, Employee Benefits Security Administration, and Centers for Medicare and Medicaid Services) Interim Final Rules were released and became effective on October 6, 2017, and will be published on October 31, 2017, allowing a greater number of employers to opt out of providing contraception to employees...

Read More

Ryan Kastner Speaks at Pennsylvania State SHRM Conference

Earlier this morning, Innovative’s Employee Benefits Consultant, Ryan Kastner, had the pleasure of presenting at the Pennsylvania State SHRMconference in State College, PA. Ryan’s presentation, “Healthcare Trends in the Trumpcare Era” detailed the most recent national and regional employer health plan trends from the United Benefit Advisor’s Annual Health Plan...

Read MoreInnovative Employer Identity Monitoring and Restoration Services

Recently, Innovative had the pleasure of seeing Frank Abagnale speak at the UBA Conference in Chicago. You may recognize Frank’s name from the movie “Catch Me If You Can” where he was played by Leonardo DiCaprio. Frank became (in)famous for writing fake checks (among other things) as a teenager. Later...

Read More

Post-Equifax Cyber Breach: Retirement Plan Sponsor Considerations

Plan sponsors have a fiduciary obligation to safeguard and preserve the assets of their employee benefit plans. As the number of cyber hacks continues to increase, plan fiduciaries must take certain steps to protect plan assets. Measures include evaluating security measures currently implemented by your organization, understanding the plan’s service...

Read More

Post-Equifax Cyber Breach: Employer and Human Resource Considerations

Under EEOC regulations, employers can utilize credit checks when hiring employees, provided that the information is relevant to the position. For example, an individual who will be responsible for providing sound investment advice to clients, must prove to the company that their own credit is satisfactory. However, many vendors sell...

Read MoreRegarding the New York Paid Family Leave Law

NEW YORK PAID FAMILY LEAVE LAW Eligible employees will be able to take NYPFL to take care of a seriously ill family member, to bond with a newborn, adopted or foster child, or for military exigency, as defined by the federal FMLA rules. The New York Disability Benefits Law (NYDBL)...

Read More

ACA/BCRA Update

As you know, a few weeks ago Senate Republicans drafted a bill, the Better Care Reconciliation Act (“BCRA”), in an effort to repeal and replace the Patient Protection and Affordable Care Act (“ACA”). If you remember, Republicans currently hold a 52-member majority in the Senate, therefore Senate Republicans are left...

Read More

June Compliance Recap

June was an active month in the employee benefits world. The U.S. Senate released a draft of the Better Care Reconciliation Act of 2017 which would substitute the U.S. House Resolution 1628 that aimed to repeal and replace the Patient Protection and Affordable Care Act (ACA). The U.S. Supreme Court...

Read More

March Compliance Recap

In March, the employee benefits world watched as the House Speaker unveiled a proposal to replace parts of the Patient Protection and Affordable Care Act (ACA) with the American Health Care Act (AHCA). The AHCA bill was withdrawn from consideration by the full House on March 24 because it appeared...

Read More

February Compliance Recap

February had relatively little activity in the employee benefits world because a new Secretary of the Department of Health and Humans (HHS) was recently confirmed and HHS started its rulemaking under the new administration. On February 10, 2017, the U.S. Senate confirmed Rep. Tom Price as the new Secretary of...

Read More

Impact of Opt-Out Incentives on ACA Affordability Calculations

Quick Overview of Affordability Employers may find themselves subject to a penalty if an employee goes to the Marketplace/Exchange and obtains a premium credit, because the employer plan was not affordable or does not provide minimum value. An employee is not eligible for a premium tax credit for...

Read MoreNovember 2016- Compliance Recap

November was quite an active month for compliance related updates in the law with regard to employee benefits and human resources. The IRS delayed 6055 and 6056 reporting for 2017, the Overtime Rule was delayed, the government released annual benefit plan amounts for 2017, and the IRS released advanced copies...

Read MoreCompliance Alert! – DOL Appeals FLSA Overtime Rule Injunction

As we expected, last evening, the Department of Labor filed a notice of appeal in the Fifth U.S. Circuit Court of Appeals in New Orleans. The Department of Labor’s appeal indicates plans to challenge the injunction that put the changes to the federal overtime rule on hold by a Texas...

Read MorePhishing Email Alert

The Department of Health and Human Services has issued an alert regarding phishing attempts by a company or individual utilizing the HHS Departmental letterhead under the signature of OCR’s Director. The email appears to be an official government communication and targets employees of HIPAA covered entities and their business associates....

Read MoreFLSA Overtime Rule Blocked by Federal Judge

On Tuesday, November 22, 2016, a Texas federal judge blocked the Fair Labor Standards Act Overtime Rule by issuing a nationwide preliminary injunction. The regulation was scheduled to take effect on Dec. 1 and would have raised the salary limit for which workers could be exempt for overtime pay from...

Read MoreIRS Extends 1095 Deadline

The Internal Revenue Service has just announced an extension on the 2016 Form 1095-C , Employer Provided Health Insurance Offer and Coverage. Previously, the 1095-C was due to full time employees on January 31, 2017. Although the IRS had previously indicated not to expect an extension, an extension was granted...

Read More

The Trump Administration & Healthcare Reform

On January 20, 2017, Donald J. Trump will be sworn in as the next President of our nation. Next year, Republicans will have the majority in the House of Representatives (238 Republicans, 191 Democrats) and the majority in the Senate (51 Republicans, 47 Democrats). On November 14, 2016, House Republicans...

Read More

October 2016 Compliance Recap

October was a busy month for administrative rule-making in the employee benefits world. The Internal Revenue Service (IRS) released final instructions for Forms 1094-C and 1095-C, guidance on the taxability of health care sharing ministry employer contributions, and health care information reporting tips. The Department of Health and Human Services...

Read More

The Shift to Self-Funding

Year over year, more employers are making the switch from fully-insured health plans to self-funded arrangements. As of 2015, 63% of all covered employees are on completely or partially-funded employer health plans. Innovative Employee Benefits Consultant, Ryan Kastner, was quoted in MedCity News discussing the intricacies of self-funding. To read the...

Read More

Compliance Recap- September 2016

September was not a very active month for administrative rulemaking in the employee benefits world. The Internal Revenue Service (IRS), Department of Labor (DOL), and Pension Benefit Guaranty Corporation (PBGC) extended the public comment period for the proposed Form 5500 annual return/report revision. The IRS issued rules defining terms relating...

Read More

Innovative Attends United Benefit Advisor’s Fall Conference in Chicago

The Innovative team headed to Chicago this past weekend for the United Benefit Advisor’s Fall Conference September 18th-20th. “UBA is the nation’s leading organization of independent benefit advisors who are bound by a code of conduct to actively cultivate, validate and share wisdom with busy benefit decision makers nationwide who want...

Read More

How Corporate Wellness Programs Benefit You and Your Organization

Has your organization adopted a structured wellness program? Many employers are resistant to kickoff corporate wellness programs due to lack of knowledge and fear of high start up costs and increasing the workload on their busy Human Resources department. Read more in our Wellness Program Whitepaper about how you can...

Read More

August Compliance Recap

August remained relatively quiet in the employee benefits world, with only new draft versions of the instructions for Forms 1095-C, 1095-C, 1094-B and 1095-B. The new draft versions of the specific forms were released in July. The IRS also released the annual contribution limits for health savings accounts (HSAs) and...

Read More

August Compliance Recap

August was quiet month in the employee benefits world. The Internal Revenue Service (IRS) released its 2018 affordability rate, four information letters regarding the Patient Protection and Affordable Care Act (ACA), and its draft Forms 1094 and 1095. The U.S. Department of Labor (DOL) increased the McNamara-O’Hara Service Contract Act...

Read More

The Top 5 Things to Look for in an ACA Reporting Consultant

Innovative Benefit Planning’s consultants are widely considered the Affordable Care Act experts in the Greater Philadelphia and New Jersey areas. While many employers struggled with the ACA reporting for 2015 with little support, Innovative clients slept easy with employee communications, in-depth consultations, pre-form data audits, and error resolution support. Innovative...

Read More

HRAs, HSAs, and Health FSAs – What’s the Difference?

Health reimbursement arrangements (HRAs), health savings accounts (HSAs) and health care flexible spending accounts (HFSAs) are generally referred to as account-based plans. That is because each participant has their own account, at least for bookkeeping purposes. Under the tax rules, amounts may be contributed to these accounts (with certain restrictions)...

Read More

Employment Eligibility: How to Handle Questions about Worker Identity

Reports submitted to the U.S. government that include both names and Social Security numbers (SSNs), such as 1095 and W-2 forms, are filtered through U.S. Immigration and Customs Enforcement (ICE), a division of the Department of Homeland Security (DHS). In some cases, employers will receive a No-Match Letter or an...

Read More

Compliance Recap- July 2016

During the month of July numerous new regulations were issued or proposed by federal agencies, and existing forms and processes were updated. In particular, penalties for various ERISA violations were increased, a major overhaul to Form 5500 filings was proposed, and draft 1095-C and 1094-C forms were released. Proposed regulations...

Read More

Salary Considerations under the New DOL Standards

On December 1, 2016, the Department of Labor (DOL) will implement changes raising the minimum compensation for exempt employees to $47,476 annually. While salary is just half of a two-part equation that includes a duties test of essential job functions, scrutiny is under way to analyze compensation and find solutions...

Read More

June 2016 Compliance Recap

June was another quiet month for federal agencies in relation to employee benefits. A tri-agency proposed rule regarding expatriate health plans, excepted benefits, and essential health benefits was released. UBA Updates UBA’s Human Resources department released a checklist and advisor on new OSHA requirements: OSHA Reporting Changes: Employer Checklist OSHA’s...

Read More

Interim Final Rule Updating the Penalties for Certain ERISA Violations

In the beginning of July, the Department of Labor (DOL) issued an interim final rule, effective August 1, 2016, adjusting the amounts of civil penalties as required by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015. In order to improve the effectiveness of civil monetary penalties, maintain their deterrent...

Read More

Proposed Rule Offers Guidance on Expatriate Health Plans, Excepted Benefits and Essential Health Benefits

In a tri-agency proposed rule, the Department of Labor (DOL), Department of Health and Human Services (HHS), and Department of Treasury (Treasury) have published guidance discussing expatriate health plans (expat plans), excepted benefits, and essential health benefits (EHBs). Expatriate Health Plans The proposed rule would allow expatriate health plans, employers...

Read More

1095/1094 Reporting Accepted…with Errors?

Ryan Kastner – Employee Benefits Consultant Mid and large size employers have begun to breathe a sigh of relief knowing the first year of 1095/1094 Reporting is almost behind us. Unfortunately, 70% of employers are unable to fully relax as many are receiving notices of “filing discrepancies” within their 1095...

Read More

OSHA Issues a Final Rule on Electronic Tracking of Workplace Injuries & Illnesses

Is your organization tracking workplace illnesses and injuries in accordance with new laws? Beginning in 2017, certain employers with as few as 20 employees at a single site will be required to electronically file information about employee injuries and accidents that occurred in the prior year. This means that, for many...

Read More

Nondiscrimination Regulations Relating to Sex, Gender, Age, and More Finalized

On May 13, 2016, the Department of Health and Human Services (HHS) issued a final rule implementing Section 1557 of the Patient Protection and Affordable Care Act (ACA), which will take effect on July 18, 2016. If entities need to make changes to health insurance or group health plan benefit...

Read More

Seven Common Mistakes That Could Trigger a DOL Audit

Here are some great tips on how to avoid a DOL audit from the UBA Blog: Not many things incite more fear than receiving a notice that you’re about to have an audit, especially from the Department of Labor (DOL). The DOL is a cabinet-level department of the U.S. federal...

Read More

Compliance Recap – March 2016

The government was busy during the month of March, issuing the massive Benefit Payment and Parameters rule in addition to numerous other updates. The IRS has added filing errors relating to Form 5500 to its project list, and multiple federal agencies confirmed that the just-announced templates relating to the...

Read More

IRS Reporting Tip #2 – Form 1095-C, Line 14, Code 1A versus 1E, and When To Use 1I

Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance, while applicable large employers (ALEs) are required to offer health benefits to their full-time employees. In order for the Internal Revenue Service (IRS) to verify that (1) individuals have the required minimum essential coverage,...

Read More

IRS Reporting Tip #1 – Form 1094-C, Line 22

Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance while applicable large employers (ALEs) are required to offer health benefits to their full-time employees. In order for the Internal Revenue Service (IRS) to verify that (1) individuals have the required minimum essential coverage,...

Read MoreBenefit and Payment Parameters Rule and HIP FAQ

The 2017 Benefit and Payment Parameters (BPP) rule, an annual rule that sets policies relating to the Patient Protection and Affordable Care Act (ACA), has been released by the Centers for Medicare and Medicaid Services (CMS). The 2017 rule contains numerous updates, including the annual open enrollment periods for the...

Read More

Proposed Summary of Benefits and Coverage Template and Updates

A Summary of Benefits and Coverage (SBC) is four-page (double-sided) communication required by the federal government. It must contain specific information, in a specific order and with a minimum size type, about a group health benefit’s coverage and limitations. In February 2016, the Department of Labor (DOL) issued proposed revisions...

Read More

Compliance Recap- January 2016

January was a very quiet month for compliance, on the heels of the multitude of delays that came at the end of December 2015. The IRS updated its FAQs related to 6055 and 6056 reporting under the Affordable Care Act (ACA). UBA Guides and Compliance Documents UBA updated the popular...

Read More

IRS Updates FAQs Related to 6055/6056 Reporting

The long-standing IRS FAQs related to reporting under sections 6055 and 6056 on requirements provided by the Patient Protection and Affordable Care Act (ACA) have been updated in January 2016 to reflect new information. Final instructions for both the 1094-B and 1095-B and the 1094-C and 1095-C were released in...

Read More

Compliance Recap – December 2015

2015 went out with a bang, as federal agencies and the White House issued a number of major delays relating to employee benefits. Most significantly, IRS reporting for the Patient Protection and Affordable Care Act’s play or pay requirement has been delayed, for both forms being sent to employees and...

Read More

IRS Final Rule on Minimum Value

In December 2015, the Internal Revenue Service (IRS) issued a final rule that clarifies various topics relating to the Patient Protection and Affordable Care Act (ACA) and premium tax credit eligibility provisions. The rule finalizes regulations that were proposed years earlier. Child Income The final rule clarified language relating to...

Read More

IRS Provides Major Delay in 6055 and 6056 Reporting

Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance, while applicable large employers (ALEs) are required to offer health benefits to their full-time employees. In order for the Internal Revenue Service (IRS) to verify that (1) individuals have the required minimum essential coverage,...

Read More

COBRA and the Affordable Care Act

The Consolidated Omnibus Budget Reconciliation Act COBRA requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. COBRA provisions are found in the Employee Retirement Income Security Act (ERISA), the...

Read More

Omnibus Bill Signed Into Law; Delays Cadillac Tax

President Obama has signed the omnibus legislation that includes the Consolidated Appropriations Act for 2016 and a tax extenders package. The agreement will keep the federal government running through September 2016. Within the legislation is language that significantly impacts provisions of the Patient Protection and Affordable Care Act (ACA), largely...

Read More

IRS Notice 2015-87: HRAs, Affordability, and More

On December 16, 2015, the Internal Revenue Service (IRS) and other federal agencies released IRS Notice 2015-87, which is a “potpourri” update that covers many different topics relating to the Patient Protection and Affordable Care Act (ACA), including some relating to market reforms. The Notice generally covers health reimbursement arrangements...

Read More

Proposed Benefit Payment and Parameters Rule Released

Federal agencies have released the proposed rule for the 2017 Benefit Payment and Parameters. Among other items, it provides updates and annual provisions relating to: Risk adjustments, reinsurance, and risk corridors programs Cost-sharing parameters and cost-sharing reductions User fees for Federally-Facilitated Exchanges (FFEs) The standards for open enrollment for the...

Read More

Agencies Issue Final Rule on Grandfathered Health Plans and Other Initiatives

On November 13, 2015, federal agencies issued a final rule that essentially combined a variety of interim final rules and non-regulatory guidance on a variety of Patient Protection and Affordable Care Act (ACA) initiatives such as grandfathered health plans, preexisting condition exclusions, internal and external appeals, rescissions of coverage, lifetime...

Read MoreEEOC Issues Proposed Rule Relating to Genetic Information and Wellness Programs

On October 30, 2015, the Equal Employment Opportunity Commission (EEOC) issued a Proposed rule to amend the regulations implementing Title II of the Genetic Information Nondiscrimination Act (GINA) as they relate to employer wellness programs that are part of group health plans. The Proposed rule would allow employers to offer...

Read MoreIRS Notice on Minimum Essential Coverage Reporting

Minimum essential coverage or “MEC” is the type of coverage that an individual must have under the Patient Protection and Affordable Care Act (ACA). Employers that are subject to the ACA’s shared responsibility provisions (often called play or pay) must offer MEC coverage that is affordable and provides minimum value....

Read MorePerfect Attendance! – How to Handle Leaves of Absence under the ACA

The Patient Protection and Affordable Care Act (ACA) requires applicable large employers (ALEs) to offer full-time employees health coverage, or pay one of two employer shared responsibility penalties. An ALE is an employer with 50 or more full-time or full-time equivalent employees (for 2015, this threshold is 100). A full-time...

Read MoreTemporary Safe Harbor for Online Posting of SBCs

A Summary of Benefits and Coverage (SBC) is four-page (double-sided) communication required by the federal government under the Patient Protection and Affordable Care Act (ACA). It must contain specific information, in a specific order and with a minimum size type, about a group health benefit’s coverage and limitations. An SBC...

Read MoreHHS Proposes First of Anticipated Nondiscrimination Regulations

The Department of Health and Human Services (HHS) has issued the first of the anticipated nondiscrimination rules, which sets forth proposed regulations to implement Section 1557 of the Patient Protection and Affordable Care Act (ACA). Section 1557 provides that individuals shall not be excluded from participation, denied the benefits of,...

Read MoreAffordable Care Act Information Returns

Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance while applicable large employers (ALEs) are required to offer health benefits to their full-time employees. In order for the Internal Revenue Service (IRS) to verify that (1) individuals have the required minimum essential coverage,...

Read More6055 Reporting, HRAs, and “Supplemental Coverage”

The Affordable Care Act (ACA) implemented section 6055 of the Internal Revenue Code, which requires IRS reporting from any entity that provides “minimum essential coverage” (MEC) to individuals. Employers who are applicable large employers (ALEs) have related reporting obligations under section 6056. Beginning in 2013, during the proposed rulemaking stage,...

Read MoreIRS Releases Draft 2015 Instructions for 6055/6056 Reporting

Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance while applicable large employers (ALEs) are required to offer health benefits to their full-time employees. In order for the Internal Revenue Service (IRS) to verify that (1) individuals have the required minimum essential coverage,...

Read MoreVeterans with TRICARE; VA Coverage Won’t Count Toward Applicable Large Employer Status

The Surface Transportation and Veterans Health Care Choice Improvement Act (STVHCC) of 2015 was signed into law by President Obama on July 31, 2015. The Act, also known as H.R. 3236, is focused on surface transportation programs but affects rules regarding how to count employees under the Patient Protection and...

Read MoreIRS Issues Second Notice to Assist in Developing Cadillac Tax Regulations

The IRS has issued its second notice regarding the upcoming implementation of the Patient Protection and Affordable Care Act’s (ACA) excise tax on high cost employer-sponsored health coverage, also known as the “Cadillac tax.” Beginning in 2018, plans that provide coverage that exceeds a threshold will owe the tax. The...

Read MoreDOL Issues Guidance on Classification of Independent Contractors

The Department of Labor (DOL) has issued an “Administrator’s Interpretation” to assist employers in determining if a worker is an employee or an independent contractor. The DOL has determined that many employers are incorrectly classifying employees as independent contractors, which can harm the worker and open the employer up...

Read MorePreventive Services Final Rules

Federal agencies released final regulations on the preventive services mandate of the Patient Protection and Affordable Care Act (ACA) that requires non-grandfathered group health plans to provide coverage without cost-sharing for specific preventive services, which for women include contraceptive services. After pushback from religious employers, interim final regulations, objections from certain...

Read MoreMid-Size Employers: Transition Relief and Community Rating

The employer shared responsibility (i.e., “play or pay”) requirements went into effect in 2015 for large employers only (those with 100 or more full-time or full-time-equivalent employees). Even though they generally will not be liable for penalties until 2016, mid-size employers (employers with 50 to 99 full-time or full-time-equivalent employees)...

Read MoreTrade Bill Increases ACA Reporting Penalties;

Most employers are familiar with the penalties assessed to applicable large employers that fail to offer minimum essential coverage that is minimum value and affordable. In addition to being required to offer coverage, employers (all applicable large employers, and all employers with self-funded plans regardless of size) are required to...

Read MoreU.S. Supreme Court Finds Same Sex Marriage Is Protected by the 14th Amendment

The Supreme Court ruled in Obergefell v Hodges, that the 14th Amendment requires a state to license a marriage between two people of the same sex, and to recognize a marriage between two people of the same sex when their marriage was lawfully licensed and performed out of state. The...

Read MoreMid-Size Employers: Transition Relief and Community Rating

The employer shared responsibility (i.e., “play or pay”) requirements went into effect in 2015 for large employers only (those with 100 or more full-time or full-time-equivalent employees). Even though they generally will not be liable for penalties until 2016, mid-size employers (employers with 50 to 99 full-time or full-time-equivalent employees)...

Read More2015 Cost-of-Living Adjustments

Many employee benefit limits are automatically adjusted each year for inflation (this is often referred to as an “indexed” limit). The Internal Revenue Service and the Social Security Administration have released a number of indexed figures for 2015. Limits of particular interest to employers include the following. For health and...

Read MoreTransitional Reinsurance Fee Filing Date Extended to December 5

The Centers for Medicare and Medicaid Services (CMS) has extended the deadline for group health plans to complete their 2014 transitional reinsurance fee (TRF) submission. The announcement, which was released late on November 14, 2014, states that the filing is now due by 11:59 p.m. on Friday December 5, 2014....

Read More2015 Cost-of-Living Adjustments

The IRS has issued the cost-of-living adjusted figures for qualified plans and for several fringe benefits for 2015. Of particular interest to many employers are: • An increase in the maximum employee contribution to a health flexible spending account (HFSA) to $2,550 • An increase in the 401(k) and 403(b)...

Read MoreRequirement to Obtain a Health Plan Identifier (HPID) Delayed

On Friday October 31, 2014 the Department of Health and Human Services (HHS) quietly updated its Health Plan Identifier information page to delay the requirement that insurance carriers and self-funded health plans obtain a health plan identifier (HPID). The delay is in effect until further notice. Plans that have already...

Read MoreHighlights of Wellness Program Requirements

The wellness program rules provide an exception to the general rule that employers may not take a person’s health status into account with respect to eligibility, benefits, or premiums under a group health plan. Wellness programs, therefore, are allowed if they are designed to help employees improve their health; if...

Read MoreFrequently Asked Questions about Grandfathered Plans

As employers determine their plan designs for the coming year, those with grandfathered status need to decide if maintaining grandfathered status is their best option. Innovative, in conjunction with our Partner firm United Benefit Advisors, has created an FAQ to address the questions employers have about grandfathering a group health...

Read MoreEssential Health Benefits, Minimum Essential Coverage, Minimum Value Coverage – What’s The Difference?

The Patient Protection and Affordable Care Act (PPACA) uses terms that sound alike for three very different things. Here’s a closer look at these terms, and when they’re used. Essential Health Benefits Significantly affects individuals and small employers with a fully insured plan. Has a limited impact on self-funded and...

Read MoreUpdate: Same-Sex Marriages and Group Health Benefits

On October 6, 2014, the Supreme Court of the United States declined to review seven cases in which the lower appeals court had ruled that a state law or constitutional provision that prohibited same-sex marriage was unconstitutional. This declination means that the ruling of the appeals court is law, and...

Read MoreCompliance Alert! Deadline Approaching for Larger Self-Funded Health Plans To Obtain a Health Plan Identifier Number

To meet federal requirements, large health plans must obtain a national health plan identifier number (HPID) by November 5, 2014. For this requirement, a large health plan is one with more than $5 million in annual receipts. The Department of Health and Human Services (HHS) has said that since health...

Read MoreIRS Notice Addresses Handling of Changes in Measurement and Stability Periods

Large employers (for 2015, this generally means those with 100 or more full-time or full-time equivalent employees) may use either the monthly or look-back method to determine whether an employee on average works 30 or more hours per week, and for whom a penalty may be owed if adequate health...

Read MoreExcepted Benefits – “Limited Scope” Dental and Vision Plans and EAPs

On September 26, 2014, the U.S. Department of Health and Human Services (HHS), the Internal Revenue Service (IRS), and the Department of Labor (DOL) released final regulations that explain when dental and vision plans and employee assistance plans (EAPs) will be considered “excepted benefits.” Excepted benefits are health benefits that are...

Read MoreIRS Allows Additional Section 125 Change in Status Events

On September 18, 2014, the Internal Revenue Service (IRS) issued Notice 2014-55 which allows employers to amend their Section 125 plans to recognize several new changes in status events. Open Enrollment in the Health Insurance Marketplace Prior to this new notice, an opportunity to enroll in the health insurance Marketplace (or...

Read MoreOur September Educational Events were a Tremendous Success!

Our Innovative team presented an educational seminar at DelFrisco’s Double Eagle Steakhouse in Philadelphia on September 19th, and also at Fleming’s Steakhouse in Marlton on September 25th. The events, which introduced innovative solutions for controlling the costs within your health plan while complying with PPACA, attracted C-level executives as well...

Read MoreIRS Issues Drafts of Instructions for Employer and Individual Responsibility Reporting Forms

The following is a summary of draft instructions. Some of this information may change when the final forms and instructions are released. In order for the Internal Revenue Service (IRS) to verify that individuals have the required minimum essential coverage, individuals who request premium tax credits are entitled to them,...

Read MoreFrequently Asked Questions about the Transitional Reinsurance Fee (TRF)

The transitional reinsurance fee (TRF) applies to fully insured and self-funded major medical plans for 2014, 2015, and 2016. The purpose of the fee is to provide funds to help stabilize premiums in the individual insurance market in view of uncertainty about how the Patient Protection and Affordable Care Act...

Read MoreGroup Health Plan Notices: What Do You Need To Include?

Employers that sponsor group health plans are required to give eligible employees a number of notices each year. Some notices must be given by a particular date, and some must be given as part of the enrollment packet. (This means that non-calendar year plans may need to provide Medicare Part...

Read MoreHighlights of the Summary of Benefits and Coverage Requirement

Plan administrators of group health plans, which includes all employers regardless of size or type of business with the exception of those that have been grandfathered, must provide a Summary of Benefits and Coverage (SBC) to eligible individuals. This requirement applies primarily to medical (PPO, HDHP, HMO, etc…) coverage. There...

Read MoreIRS Issues Drafts of Individual Responsibility Reporting Forms

The following is a summary of draft forms. Some of this information may change when final forms, and the instructions, are released. In order for the IRS to verify that individuals and employers are meeting their shared responsibility obligations, and that individuals who request premium tax credits are entitled to...

Read MoreA September Lunch Event Is On The Calendar!

On February 10, 2014, the IRS issued final regulations on the employer requirements, often known as “Play or Pay.” For some employers Play or Pay is delayed until 2016, for others, compliance is still required in 2015. Make sure you know where you stand. Please join us on Friday September...

Read MoreCost of Living Adjustments for 2015

Many of the thresholds in PPACA have annual cost-of-living adjustments. The IRS has released the 2015 “affordability” thresholds. Affordability is measured differently for purposes of eligibility for the premium tax credit/subsidy (and any employer-shared responsibility penalty triggered by an employee receiving a premium subsidy) and the individual-shared responsibility penalty. For...