Retirement plans

Secure 2.0 Retroactive Amendment

As we approach the end of the year, it’s important for Plan Sponsors to be aware of the new tax planning opportunities available under the SECURE Act. Plan Sponsors are now able to make a new tax-favored contribution to their existing plan after the close of their current tax year....

Read More

Gag Clause Prohibition Compliance Attestation Due by December 31, 2024

Background When the Consolidated Appropriations Act, 2021 (CAA) was enacted by Congress on December 27, 2020, the law included a provision preventing group health plans and health insurance carriers from entering into health plan services contracts (such as a third-party administrator or health care provider contracts) with gag clauses...

Read More

Catch Up Provisions

New Catch-Up Limits Under Secure Act 2.0 As a plan sponsor, it’s crucial to stay informed about legislative changes that impact retirement plans. The Secure Act 2.0, signed into law on December 29, 2022, introduces several significant updates aimed at enhancing retirement security for Americans. One of the key optional...

Read More

RetireReady NJ Exemption Registration is Fast Approaching!

RetireReady NJ Exemption Registration is Fast Approaching The New Jersey Secure Choice Savings Program Act requires certain New Jersey employers to establish a retirement savings program through the RetireReady NJ program, if they do not already sponsor a retirement savings plan. Once the program is established by the employer, New...

Read More

Retirement Plan Checklist For Plan Sponsors

End of Year Checklist for Plan Sponsors: Ensuring Compliance and Maximizing Benefits As we approach the 4th quarter of 2024, it’s crucial for plan sponsors to take a proactive approach in reviewing their retirement plans. This end-of-year checklist will help ensure compliance with regulatory requirements and optimize the benefits for...

Read More

Secure 2.0 Student Loan Matching

The SECURE Act 2.0 allows employers to match employee student loan payments with retirement plan contributions. This benefit aims to help employees burdened with student debt save for retirement. Plan sponsors can implement this benefit to improve recruiting and retention. However, employers must navigate several considerations and challenges to implement...

Read More

Navigating Auto-Portability in Retirement Plans: Key Fiduciary and Liability Considerations Under SECURE Act 2.0

The introduction of auto-portability rules under SECURE Act 2.0 aims to simplify transferring small retirement accounts when employees change jobs, reducing cash-outs and enhancing retirement savings. However, plan sponsors must consider fiduciary and liability implications before adopting this feature. Fiduciary Responsibilities Plan sponsors are fiduciaries under the Employee Retirement Income...

Read More

Secure 2.0 Auto-Portability

Auto-Portability Explained: Auto-portability is a feature designed to help plan participants consolidate their retirement accounts when they change jobs. Here’s how it works: Problem: When employees switch employers, they often leave behind small balances in their old 401(k) accounts. These “orphaned” accounts can lead to administrative burdens for plan sponsors and...

Read More

Secure 2.0 Involuntary Cash-Out Provision

In today’s complex benefits landscape, plan sponsors face the challenge of managing retirement plans efficiently while ensuring compliance and participant satisfaction. One effective solution is the practice of involuntary cash-outs, which involves automatically distributing the retirement accounts of former employees when balances fall below a specified threshold. Integrating this provision...

Read More

SECURE 2.0: IRS Issues Guidance on De Minimis Financial Incentives and Employer Roth Contributions

The Secure Act 2.0 has been signed into law with the goal of promoting retirement security among Americans. The bill contains dozens of provisions that will impact various aspects of retirement plans. As a plan sponsor, it’s important to understand how the Secure Act 2.0 will impact your organization and...

Read More

Tax Planning Profit Sharing

Navigating the complexities of tax planning, employers are constantly on the lookout for strategies that not only maximize their financial health but also amplify the value they provide to their employees. Among these strategies, profit sharing emerges as a standout approach, marrying financial prudence with a commitment to employee welfare....

Read More

Secure 2.0 Emergency Savings

The IRS recently issued guidance regarding various provisions of Secure Act 2.0, including the “Pension-linked Emergency Savings Account” (PLESA) provision. This provision aims to alleviate financial strain on employees facing hardships. Effective January 1st, 2024, non-highly compensated employees can contribute to an emergency savings account through payroll deferrals. Participants can...

Read More

IRS Issues Additional Guidance for SECURE 2.0 Act

In an effort to provide necessary clarity for employers and plan sponsors, the Internal Revenue Service (IRS) issued long-awaited guidance for various provisions under the SECURE 2.0 Act (SECURE 2.0). This guidance comes in Question-and-Answer format and addresses twelve of the 90+ provisions under SECURE 2.0. Specifically, provisions related to...

Read More

IRS Releases 401(k) Guidance For Long-Term Part-Time Employees Under the Secure 2.0 Act

On November 24, 2023, the IRS released long-awaited guidance around the updated 401(k) eligibility requirements pertaining to long-term part-time employees (LTPT) under the SECURE 2.0 Act of 2022 (SECURE 2.0). These proposed regulations, if finalized, would amend the rules previously applicable to 401(k) plans and provide additional clarification for some...

Read MorePS Plan and Retroactive Amendment

Under the SECURE Act, employers can adopt a profit-sharing plan for the prior year, as long as the plan is established before the employer’s tax-filing deadline, including extensions. This means that an employer could potentially adopt a profit-sharing plan as late as October 15th of the following year. Effective on...

Read More

Ways to Improve Retirement Planning

As a plan sponsor, enhancing retirement plan performance is vital for the benefit of both participants and the plan’s long-term success. Effective strategies to improve retirement plan performance include: Implementing automatic features, such as enrollment and deferral escalation Offering a diverse menu of investment options for participants of all investment...

Read More

IRS Delays Roth Catch-Up Contribution Requirement under SECURE 2.0 Act

In light of concerns expressed by plan sponsors and participants alike, the IRS released Notice 2023-62 (“Notice”) which provides a two-year extension on the requirement related to Roth catch-up contributions under SECURE 2.0 Act (“the Act”). Specifically, the Notice states, “The Department of Treasury and the IRS have been made...

Read MoreFee Transparency

Fee analysis and transparency are vital for successful retirement plans. Understanding fee impacts and conducting benchmarking helps plan sponsors make informed decisions and protect themselves as fiduciaries. Below, we explore various fee types, and offer guidance for effective fee management in retirement plans. Fee analysis affects plan performance directly. Transparent...

Read More

Participant Retirement Readiness

Assessing the effectiveness of your retirement plan is vital for ensuring participants’ readiness for retirement. By measuring retirement readiness, evaluating your plan’s performance, and implementing key strategies, you can improve participants’ preparedness. In this blog, we will discuss the importance of measuring retirement readiness, provide insights into evaluating plan effectiveness,...

Read More

5 Reasons to Hire a Financial Advisor for Your Retirement Plan

When managing a retirement plan, plan sponsors are faced with decisions that can affect the entire organization such as plan design, investment line-up, and who the recordkeeper will be. Unfortunately, many plan sponsors are not experts in qualified retirement plans or the ERISA laws that govern them. Decision makers for...

Read More

Missing Participant and Uncashed Checks

As a plan sponsor of a company retirement plan, it is important to have a process for locating missing participants and notifying participants of uncashed checks. Failure to do so can result in penalties and fines from regulatory agencies, as well as potential litigation from participants. Missing participants are those...

Read More

Profit Sharing Plan and Retroactive Amendment

As a follow-up to last month’s blog on the benefits of retroactively establishing a profit-sharing plan, the Secure Act 2.0 also gives retirement plan sponsors the ability to retroactively amend their existing plans to increase plan benefits as long as the plan is amended prior to the filing of the...

Read More

Tax Planning and Profit Sharing Plan

If you’re a business owner looking to save for retirement while also reducing your taxable income, adding a profit-sharing component to an employer retirement plan could be an attractive option. Not only does it allow you to set aside a portion of your profits for your retirement, but a profit-sharing...

Read More

Secure Act 2.0

The Secure Act 2.0 is poised to be signed into law with the goal of promoting retirement security among Americans. The bill contains dozens of provisions that will impact various aspects of retirement plans. As a plan sponsor, it’s helpful to understand how the Secure Act 2.0 will impact your...

Read More

Retirement Plan Solutions to Address the Tight Labor Market

Employers who face staffing challenges in the current worker-driven labor market are implementing innovative retirement plan solutions to help them recruit new candidates and retain experienced personnel. Over the past two years, organizations have lost millions of valued team members as the Great Resignation and the Great Retirement boosted turnover....

Read More

Three Major Differences Between a Broker and Fiduciary Plan Sponsor

For plan sponsors, managing a 401(k) plan can be complex and time-consuming. Some plan sponsors hire outside advisors to help the plan stay compliant with the various IRS and ERISA regulations. When hiring outside advisors, many plan sponsors are unaware of the added benefits of hiring an investment fiduciary as...

Read More

The DOL’s Compliance Assistance Release No. 2022-01 401(k) Plan Investments in “Cryptocurrencies”

As plan advisors, we’ve had increasing questions from plan sponsors and committees about the availability and merits of Crypto backed investment options. With their release last week, the DOL has made their position very clear: they will investigate plan fiduciaries who make these types of investments available, even through brokerage...

Read More

Tax Planning Opportunities Through Proper Retirement Plan Design

Many business owners, principals, and executives are not aware of the tremendous personal and corporate tax benefits that can be achieved through the proper retirement plan design. Most retirement plans are designed for administrative efficiency – not for tax planning purposes. As a result, most businesses are not aware of...

Read More

End-of-Year Reminders for Companies with Retirement Plans

As 2021 draws to a close and everyone begins preparing for a new year, employers with qualified retirement plans should review several factors that could affect their plans before moving on to 2022. The fourth quarter presents a perfect opportunity for plan sponsors to take a snapshot of the year’s...

Read More

Innovative Investment Fiduciaries Receives CEFEX Certification for 3rd Consecutive Year

Over the years, we have worked hard to earn a trusted reputation, which is why we are honored to announce our certification renewal with CEFEX, the Centre for Fiduciary Excellence, LLC, for the third consecutive year. CEFEX is an independent global assessment and certification organization. Its mission is to promote...

Read More

Benefits of a CEFEX Certified Advisor

Benefits of a CEFEX Certified Advisor A CEFEX (Centre for Fiduciary Excellence) certified advisory firm adheres to a standard representing the best practices in their industry. They abide by a global fiduciary standard of excellence with specific criteria covering 21 best practices. In fact, the documented repeatable processes and the...

Read More

Discover How We Helped One Client Reduce Their Retirement Plan Fees by 30%

Discover How We Helped One Client Reduce Their Retirement Plan Fees by 30% When offering your plan directly with a qualified plan provider, many employers are not aware of what they might be missing. As a result, we often find that many Plan Sponsors are paying more and receiving less....

Read More

5 Steps to Create a Financial Wellness Program

5 Steps to Create a Financial Wellness Program Many employers offer health wellness programs for their organization. However, financial wellness is equally as important. Studies show that 47% of employees are stressed about their finances, which can impact their productivity in the workplace. While starting a financial wellness program may...

Read More

Environmental, Social and Governmental (ESG) Fund Best Practices for Plan Sponsors

Environmental, Social and Governmental (ESG) Fund Best Practices for Plan Sponsors Socially responsible investing has grown in popularity as investors become more aware of how organizations operate from an environmental, social and governance perspective. Environmental factors may include a company’s carbon output, overall resource consumption and impact to air and...

Read More

2021 Plan Sponsor Considerations

The events of 2020 created many new considerations for plan sponsors as individuals were faced with uncertainty and sought safety both financially and personally. The CARES Act was passed to assist individuals and businesses impacted by the pandemic, and investors witnessed a volatile investment market causing many to adjust their...

Read More

IRS Announces 2021 Plan Limitations

IRS Announces 2021 Plan Limitations The IRS has recently announced the qualified plan limitations for 2021, which are determined based on annual increases in the cost of living index. Because there was only a modest increase in the index, most of the plan limits have not changed from 2020. For...

Read More

How Working With a Qualified Plan Advisor Can Improve Your Audit Experience

How Working With a Qualified Plan Advisor Can Improve Your Audit Experience Hiring a quality qualified plan advisor provides many advantages to employers that sponsor a retirement plan. Specifically, one of those advantages is improving your annual qualified plan audit. As each audit season begins, employers often dread having to...

Read More

Dust Off That Old Policy: Why Now is a Good Time to Review Your Life Insurance Policies

Dust Off That Old Policy: Why Now is a Good Time to Review Your Life Insurance Policies As a result of the COVID-19 National Emergency, insurance companies have modified their underwriting requirements to help individuals secure additional life insurance protection. Through new “relaxed” underwriting guidelines, insurers are offering coverage without...

Read More

Participant Risk Assessment

Participant Risk Assessment As we work our way through a market recovery and closer to what could be a greater period of uncertainty around the upcoming election, now may be a good time for participants to review the equity risk associated with their retirement account and understand if their current...

Read More

What Steps Can Plan Sponsors and Retirement Plan Committee Members Take to Protect Themselves?

What Steps Can Plan Sponsors and Retirement Plan Committee Members Take to Protect Themselves? When managing a qualified retirement plan, there are certain duties the plan sponsor and committee members have to the plan and participants as named fiduciaries. These duties create liability for the plan sponsor and committee members...

Read More

Put Your Advisor to the Test

Put Your Advisor to the Test Ask these critical questions to test the knowledge of future plan advisors. A knowledgeable plan advisor is an important component in the successful operation of your qualified plan. However, selecting the right candidate requires more than simply reviewing typical Request for Proposal (RFP) responses....

Read More

COVID-19 Impact on Retirement Plan Discrimination Testing

COVID-19 Impact on Retirement Plan Discrimination Testing As a result of COVID-19, many employers have made financial, operational, and employment-related changes. Plan sponsors need to consider how the following actions may impact the results of their 2020 retirement plan discrimination testing: Changing or Discontinuing the employer 401K match Retirement plan...

Read More

Paycheck Protection Program (PPP) Loan Forgiveness Application

Paycheck Protection Program (PPP) Loan Forgiveness Application On Friday, May 15th the SBA has released their forgiveness application with detailed instructions on how to complete the form. While the release promised further guidance on loan forgiveness, Innovative has received a lot of questions surrounding the calculation of Full Time Equivalent (FTE)...

Read More

4 Tips for a Volatile Market

The COVID-19 National Emergency has impacted nearly every part of our daily lives and the investment market is no exception. When account balances fluctuate, it is tempting to make quick investment decisions. Before you do, consider a few investing tips to guide your investments through volatile markets. Remain Calm Many...

Read More

CARES Act: Impact on your Retirement Plans

CARES Act: Impact on your Retirement Plans The CARES Act is the stimulus package the government recently enacted to support the country and economy during and after the coronavirus pandemic. The 880-page Act has many programs and features that affect a wide range of the economy. The points below are...

Read More

Student Loan Relief Due to COVID-19

Overview On March 13, 2020, the U.S. Department of Education announced that it would waive interest charges, allow for suspended payments and provide assistance to borrowers of defaulted loans for 6 months. All information can be found at StudentAid.gov. Who Is Affected? All borrowers who have an outstanding federal student...

Read More

Ways Employers Can Deal With Employee Student Loan Debt

Ways Employers Can Deal With Employee Student Loan Debt February 25th, 2020 Student debt has increased dramatically in recent years, creating a financial burden on employees’ ability to save for retirement. Many employers have begun implementing programs to help employees manage student loan debt. Millennials (and their families) are often...

Read More

Myth Series #12: I can’t offer a student loan program in my retirement plan.

With student loan debt reaching astronomical numbers, employers are increasingly looking for ways to add student loan assistance programs to their benefits packages. While current student loan repayment programs can relieve financial stress, they do not offer tax benefits to employees. However, a recent IRS Private Letter Ruling allowing a...

Read More

Broker vs. Fiduciary: The differences you must know

For plan sponsors, running a 401(k) plan can be complex and time-consuming. Some plan sponsors hire outside advisors to help the plan stay compliant with IRS and ERISA laws. It is crucial to understand the difference between hiring a broker versus hiring a fiduciary. Each has a unique set of...

Read More

Required Minimum Distributions

As the calendar year draws to a close, older plan participants may have to consider taking a required minimum distribution (RMD) from their qualified retirement plan. A required minimum distribution is a withdrawal from a qualified retirement plan for participants who have reached the age of 70½. While many qualified...

Read More

Innovative Myth Series #11-As a plan sponsor, I shouldn’t consider adding a 3(16) service to my plan.

An existing client had experienced problems with their 401(k) plan audit for several consecutive years due to internal operational issues. The client requested our help in determining whether they should spend the money for a 3(16) service to help improve efficiencies and eliminate some of the operational errors they were experiencing....

Read More

Innovative Benefit Planning Earns Specialized Advisor Recognition

Our firm was founded on the principles of integrity, professionalism and exceptional client service. We are also deeply committed to continuous improvement. Our dedication to doing what is best for you, our clients, prompted us to engage CEFEX, the Centre for Fiduciary Excellence, LLC to audit our processes. In June...

Read More

Innovative Myth Series #10: When Transferring Service Providers, There are no Pitfalls, Part 2 – Market Value Adjustments and Fixed Accounts

A new client engaged Innovative after they decided to transfer their current plan to a new service provider. After our initial investment review, we noticed there was an existing Stable Value Fund, which was subject to a market value adjustment (MVA). When an MVA is being applied, a complete fund...

Read More

Should you Consider a Safe Harbor Contribution Feature?

Does your organization’s retirement plan frequently refund money to highly compensated employees (HCE)? Do you want to provide a great incentive to your employees to save for retirement and perhaps allow them to retire earlier? Would the owners and highly compensated employees like to save more of their own money?...

Read More

5 Reasons To Hire the Right Financial Advisor For Your Retirement Plan

As an organization offering a retirement plan to their employees, plan sponsors are faced with decisions that can affect the entire organization. The plan design, investment line-up, and who the recordkeeper will be are typical for all plans. Beyond these standard decisions, there is the issue of knowing and understanding...

Read More

Innovative Myth Series #9: When Transferring Service Providers, There Are No Pitfalls. Part 1-Protected Benefits

A new client engaged Innovative to transfer their current plan to a new service provider. During the course of our detailed review, we discovered that certain employees had annuity contracts with death benefits that exceeded the value of their plan investments. If the client executed the transfer, these participants would...

Read More

Innovative Myth Series #8: Once I Sell a Company, I Don’t Have To Worry About It Impacting My Current Retirement Plan

See how Innovative helped our client from running afoul of the Affiliated Service group rules and saved the client from potential serious regulation issues. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here.

Read More

Innovative Myth Series #7: The Only Benefit To A Retirement Plan is Retirement Savings

See how Innovative helped this client add a pension plan to their existing 401(k) and profit-sharing plan offerings to tackle their recruiting and retention challenge. Download full case study here. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here.

Read More

Innovative Myth Series #6: Funding a Profit Sharing Plan for a Company with More Than 100 Employees Will Only Benefit My Employees

See how Innovative helped one client generate significant tax savings for their company. Download full case studyhere. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here. Download full case...

Read More

The Importance of a Roth Option in Retirement Plans

Roth contributions can provide significant benefits to retirement plans for both participants and plan sponsors alike. But what does Roth mean? Unlike pre-tax, Roth refers to post-tax dollars, meaning the money has already been taxed when it goes into a participant’s account. They are beneficial to participants because qualified Roth...

Read More

Innovative Myth Series #5: Plans With No Financial Consultant Receive The Best Fees And Fiduciary Protection From Their Qualified Plan Provider

See how Innovative’s experience with reviewing “Retirement Plan Relationships” helped one client in negotiating lower administrative fees, increased services for the plan sponsor and streamlined administrative functions. Download full case study here. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here.

Read More

Benefits to Offering a 401(k) plan

According to the recent Jobvite’s Recruiter Nation Survey, after Healthcare, 401(k)s are considered the most valuable benefit to recruit and retain employees. Providing retirement benefits to your employees, such as 401(k) plans, is an important step in recruiting, retaining and promoting employee wellness. Recruitment and retention: Recent trends demonstrate...

Read More

Are Target Date Funds Right for Your Participants?

In recent years, plan sponsors have increased the inclusion of Target Date Retirement funds in their investment fund lineup. In fact, J.P. Morgan estimates that 88% of new retirement plan contributions are expected to flow into Target Date Funds by end of this year1. Here are some of the reasons...

Read More

Andrew May Earns Accredited Investment Fiduciary Designation

Innovative is proud to announce that Andrew May has been awarded the Accredited Investment Fiduciary designation from the Center for Fiduciary Studies, the standards-setting body for fi360. Andrew is a Financial Services Associate working in the retirement services department. He is responsible for servicing the firm’s qualified plan clients in...

Read More

Innovative Myth Series #4 Employer Profit-Sharing Deductions Must Be Recognized in the Year the Contribution is Made

See how Innovative’s strategic planning and Profit-Sharing experience helped our client maximize tax benefits and fund significant plan contributions for their key employees. Download full case study here. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here.

Read More

Innovative Myth Series #3: Mergers and Acquisitions are Simple

Innovative’s merger and divestiture of plans consulting expertise enabled us to provide complete end -to-end service. See how we helped our client ease their administrative burden and reduce client fees by over 40%. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here.

Read More

Innovative Myth Series #2: All Highly Compensated Employees are Defined by Salary Alone

See how Innovative’s experience with qualified plans helped this client to be compliant with ADP testing. Download full case study here. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here.

Read More

Innovative Myth Series #1: I Can Rely on My Recordkeeper to Manage Terminated Employees

See how Innovative’s experience with retirement plans helped this client find substantial savings by examining their 401(k) plan. Download full case study here. Let Innovative perform a complimentary review of your plan, contact our retirement planning team here.

Read More

Retirement Match on Student Loan Debt- UPDATE

In October we reported on a Private Letter Ruling the IRS issued for an employer interested in offering a student loan repayment benefit through their 401(k) plan. While the ruling only applied to the plan and plan sponsor who requested it, we suspected at the time that the ruling would...

Read More

Let’s Discuss Tax Relief from Your 199A Deduction

Earlier this week we discussed the Tax Cuts and Jobs Act of 2017 and the limits placed on the deductibility of State and Local taxes for 2018. Now let’s discuss your 199A deduction. For many owners of pass-through entities, _ the new 199A deduction will generate welcome tax relief in...

Read More

There May Be a Simple Solution to Decrease the 2018 Tax Burden Through a Customized Retirement Plan Design

The Tax Cuts and Jobs Act of 2017 have limited the deductibility of State and Local taxes for 2018. As a result, many high earners may be subject to additional taxes this year. However, there may be a simple solution to decrease the 2018 tax burden through a customized retirement...

Read More

Student Loan Considerations for Plan Sponsors-Part Two

As a follow up to our first article on student loan debt, its impact on employers and the recent IRS Private Letter Ruling (PLR) regarding student loan repayments, we’ve attached a summary of items to consider when contemplating this type of arrangement. As this ruling has just been released, we...

Read More

IRS Allows 401K Match for Student Loan Repayments

The IRS recently issued a Private Letter Ruling (PLR) for an employer interested in offering a student loan repayment benefit through their 401(k) plan. While the ruling only applies to the plan and plan sponsor who requested it, the ruling will most likely expand interest in this type of program,...

Read More

Are Your Retirement Plan Committee Members Aware of Their Fiduciary Obligations?

Do your retirement plan committee members have a thorough understanding of their fiduciary obligations? In a recent court case involving the retirement plans offered at New York University, the court found that certain committee members were not fully aware of their obligations as Fiduciaries. At Innovative Benefit Planning, we assist...

Read More

Fiduciary Rule Update

As you may remember, major components of the Department of Labor (DOL) fiduciary rule have been applicable to retirement advice since June 9, 2017. However, on November 2, 2017, the DOL sent a final rule that would extend the transition period of its fiduciary rule by 18 months to the...

Read More

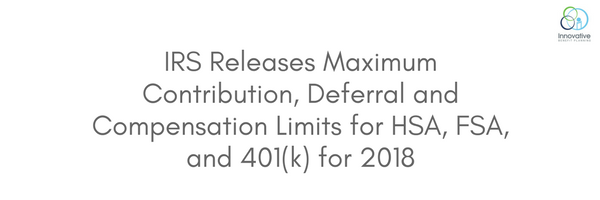

IRS Releases Maximum Contribution, Deferral and Compensation Limits for HSA, FSA, and 401(k) for 2018

The IRS has released the maximum contribution limits for Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) for 2018. The IRS also released the maximum deferral and compensation limits for 401(k) accounts. Health Savings Accounts Single Coverage Maximum Contribution Limit: $3,450 ($50 increase from 2017) Family Coverage Maximum Contribution...

Read More

Post-Equifax Cyber Breach: Retirement Plan Sponsor Considerations

Plan sponsors have a fiduciary obligation to safeguard and preserve the assets of their employee benefit plans. As the number of cyber hacks continues to increase, plan fiduciaries must take certain steps to protect plan assets. Measures include evaluating security measures currently implemented by your organization, understanding the plan’s service...

Read More

DOL Fiduciary Rule Delay Approved by Office of Management and Budget

As you may be aware, the Department of Labor requested to push back the final implementation date of the fiduciary rule, originally scheduled for January, to July 2019. The 18-month delay was approved by the Office of Management and Budget (OMB) of the White House this week. While the delay...

Read More

DOL Releases Additional Guidance Regarding the Fiduciary Rule

As part of our commitment to ensuring that our clients are kept up-to-date on the changes to applicable laws, the Department of Labor (DOL) has released additional guidance regarding the Fiduciary Rule. In our recent blog post, we discussed the applicability date of the Fiduciary Rule being delayed from April...

Read MoreThe CHOICE Act and its Impact on the Fiduciary Rule & Dodd-Frank

Late last week, the House Financial Services Committee approved the CHOICE Act for consideration by the full House of Representatives. The CHOICE Act is likely the first step towards Congressional repeal of the Department of Labor’s fiduciary rule. In addition to undoing or potentially replacing the Dodd-Frank Wall Street reform...

Read More

DOL Delays Applicability Date of the Fiduciary Rule

As you are likely aware, the Department of Labor proposed a delay to the Fiduciary Rule on March 1, 2017 in response to President Trump’s Executive Order. On April 4, 2017, the DOL made their final rule public and have delayed the applicability date to June 9, 2017. It will...

Read MoreProposed Regulations Allow for Permitted Uses of Plan Forfeitures in a 401(k) Plan

On January 18, 2017 the IRS issued proposed regulations that allowed for permitted uses of plan forfeitures in a 401(k) plan. Under these proposed rules, “Qualified Nonelective Contributions, or QNCEs and “Qualified Matching Contributions” or, QMACs would be amended to allow plan sponsors to use amounts held in the plan’s...

Read MoreThe fate of the Fiduciary Rule

As you may know, on Friday, February 3, 2017, President Trump signed a memorandum directing the Department of Labor Secretary to undertake a new “economic and legal analysis” to evaluate the Fiduciary Rule. To the extent that the new analysis reveals any issues, the Labor Secretary is directed to publish...

Read More

Innovative Presents at the BPAS Annual Conference

The Innovative team spent June 6, 7 and 8, 2016 at the Benefit Plans Administrative Services (BPAS) Annual Partner Conference in Philadelphia. The annual conference draws financial intermediary partners from across the country for three days of panels and breakout sessions covering a variety of topics including: technical and legislative updates, fiduciary...

Read More

Seven Common Mistakes That Could Trigger a DOL Audit

Here are some great tips on how to avoid a DOL audit from the UBA Blog: Not many things incite more fear than receiving a notice that you’re about to have an audit, especially from the Department of Labor (DOL). The DOL is a cabinet-level department of the U.S. federal...

Read More

DOL Announces New Fiduciary Rule

On April 16th, the Department of Labor provided the long awaited revision to the fiduciary definition in the Fiduciary Rule. The new rule has been debated for many months and clarifies what is considered fiduciary advice. Under ERISA, a fiduciary is defined as someone who exercises discretion as to the...

Read MoreInnovative Investment Fiduciaries Guest Presenters

On Tuesday, September 16th, Innovative’s Matthew Bernstein, Qualified Plan Consultant, and Mark Sulpizio, Managing Partner were asked to speak at MID Jersey Chamber of Commerce’s quarterly NPEC (Non-Profit Executive Council) meeting in Hamilton New Jersey. The presentation focused on the impact of the Department of Labor’s 408(b)(2) qualified plan fee...

Read MoreWhat Does July 31st Mean To You?

Form 5500 With the exception of government plans (including most public schools) and many church plans which are exempt, plans on a calendar year that must comply with ERISA must file Form 5500 by July 31st. This form is part of ERISA’s overall reporting and disclosure framework, which is intended...

Read MoreHave You Registered for Our July 15th Lunch Event in Cherry Hill?

Are your employees getting their fair share? In 2012, the DOL issued new disclosure regulations requiring service providers to disclose the services provided and fees charged to retirement plans. Recently, the DOL has commented that the new regulations have not produced the desired effect, that plan sponsors review the disclosures...

Read MoreAre The Fees In Your Retirement Plan Reasonable?

Are your employees getting their fair share? In 2012, the DOL issued new disclosure regulations requiring service providers to disclose the services provided and fees charged to retirement plans. Recently, the DOL has commented that the new regulations have not produced the desired effect, that plan sponsors review the disclosures...

Read MoreInnovative’s Mark Sulpizio Is Quoted In Employee Benefit Advisors

In the last few years, executive level employees have made a shift from working for larger companies, to running smaller companies. However, the benefits typically available at smaller companies can’t compare with those of their larger counterparts. So what is an employer to do in order to attract and retain...

Read MoreJoin Us May 9th For Our Princeton Lunch ‘N Learn: Are The Fees In Your Retirement Plan Reasonable?

_ Are your employees getting their fair share? _ In 2012, the DOL issued new disclosure regulations requiring service providers to disclose the services provided and fees charged to retirement plans. Recently, the DOL has commented that the new regulations have not produced the desired effect, that plan sponsors review...

Read MoreIt Was A Busy Month At Innovative With Two Outstanding Lunch Events and a Gala!

We did not let the snow get in our way in February! The month started off with _ Mark Sulpizio, Innovative Investment Fiduciaries, LLC Principal _, guiding attendees through the Retirement Fee Disclosure Regulations that went into effect in 2012 at a fantastic Seminar Lunch Event at McCormick & Schmick’s...

Read MoreDo You Know When To Use A Wrap Around Plan Document Or Wrap Around SPD?

The Employee Retirement Income Security Act of 1974 (ERISA) regulates employee pension plans and welfare benefit plans, with the exception of government and church plans. It is required by ERISA that plan sponsors describe the terms and conditions of its welfare benefit plans on an official written plan document that...

Read MoreOur November Lunch Events Were A Huge Success!

Guests at our Fiduciary Best Practices lunch event that was held at DelFrisco’s Double Eagle Steakhouse in Philadelphia on November 14th learned more about the fee disclosure regulations that went into effect in 2011. Innovative’s own Mark Sulpizio discussed how to better understand the fee disclosures provided and address what...

Read MoreIRS Announces Retirement Plan Limitations For 2014

On October 31, 2013 the Internal Revenue Service and the Social Security Administration announced cost-of- living adjustments affecting dollar limitations for pension plans and other retirement–related items for the tax year 2014. The following highlights a breakdown of limits that have changed, as well as those that remain unchanged: Limits...

Read MoreInnovative Welcomes Matt Bernstein!

We are pleased to announce the addition of Matthew Bernstein to the Innovative team. Matt is a graduate of Western New England College in Springfield, Massachusetts. As a Qualified Plan Consultant, Matt will be identifying, developing and nurturing potential client relationships in the Greater Philadelphia area. Matt is a dynamic,...

Read MoreDo You Monitor Your 3(38) Adviser?

If you don’t, maybe you should. Many people mistakenly assume that when they hire a 3(38) they no longer have to worry about any fiduciary responsibility. They are wrong. While they wouldn’t necessarily be held responsible for the day-to-day decisions made by the 3(38), over time, if they are not...

Read MoreThanks to the Fiscal Cliff Deal, Roth 401(k) Conversions Are Allowed for All

As part of the fiscal cliff deal employees have been given the ability to take funds in a pre-tax 401(k) account and convert it into a Roth 401(k) account. Prior to this most recent provision in the American Taxpayer Relief Act of 2012, only amounts that were deemed distributable could...

Read MoreCORRECTING OPERATIONAL MISTAKES CAN ELIMINATE FIDUCIARY LIABILITY

Over the past decade, plan sponsors have become familiar with the voluntary correction programs offered by the IRS and Department of Labor, including the Service’s Employee Plans Compliance Resolution System (EPCRS) and the DOL’s Voluntary Fiduciary Correction Program (VFCP). These programs offer formal ways for sponsors to correct certain administrative...

Read MoreCritical Amendment Deadline Approaching for Defined Benefit Plans

Sponsors of single-employer defined benefit pension plans will need to amend those plans soon to comply with a critical requirement of the Pension Protection Act of 2006 (the PPA). As explained more fully below, meeting this deadline is crucial because the IRS has conditioned anti-cutback relief on a timely amendment. ...

Read MoreCOMPLIANCE ALERT: 2013 Annual Benefit Plan Amounts

2013 INFLATION ADJUSTMENTS Following recent announcements by both the IRS and the Social Security Administration, we now know most of the dollar amounts that employers will need to administer their benefit plans for 2013. Many of the new numbers are slightly higher than their 2012 counterparts. For instance, the annual...

Read MoreBorzi Announces Fee Disclosure Help for Participants

June 11, 2012 — Phyllis Borzi, assistant secretary for the Employee Benefits Security Administration (EBSA), announced tools to help participants understand fee disclosures. — In her retirement security newsletter for plan participants, Borzi said the EBSA offers consumer-focused FAQs that explain the new rules for disclosures about 401(k) services and...

Read MoreInnovative Attends the 2012 Community Access Unlimited Golf Outing

Elizabeth, NJ – May 11, 2012 – While higher is not better on golf score cards the numbers turned in by the friends, supporters and community partners of Community Access Unlimited (CAU) at the agency’s 18th Annual Golf Classic were well above par. The May 10 event at Suburban Golf...

Read MoreMark and Nicole Attend the 8th Annual fi360 Conference in Chicago

Innovative’s Mark Sulpizio, MS Tax, AIF® and Nicole Offerman, AIF® joined approximately 600 advisors in Chicago for a three-day educational and networking event April 25th-27th. A full range of nationally recognized speakers such as Harvard Business Review editorial director and author of The Myth of the Rational Market Justin Fox...

Read MoreThe DoL Fights Employers Failing to Remit Contributions

The Labor Department’s Employee Benefits Security Administration (EBSA) has a long history of protecting the contributions employees make to their 401 (k), health care, and any other contributory plans by investigating employers who delay forwarding these contributions to the appropriate funding vehicle or who convert the contributions to other non-plan...

Read MoreInnovative’s Mark Sulpizio Goes To The Harvard Club

On Wednesday, February 8, 2012 our own Mark Sulpizio attended Federated Investors’ Retirement Security Symposium at The Harvard Club of New York City. This special event was by invitation only and featured The Honorable Bradford P. Campbell as the Key Note Speaker. Mr. Campbell formerly served as the Assistant Secretary...

Read MoreDOL Finalizes, Delays 401(k) Fee Disclosure Rules

After months of delay, the Department of Labor (DOL) has just released final regulations under Section 408(b)(2) of ERISA, requiring retirement plan service providers to disclose information about their services and fees to plan sponsors. In doing so, the DOL delayed the effective date of those rules and made minor...

Read MoreFiduciary Luncheons A Success Again!

Innovative would like to thank all of our guests that attended the Fiduciary Luncheons that we hosted last week in Princeton, Parsippany and Philadelphia. Innovative’s own Mark Sulpizio, Accredited Investment Fiduciary®, discussed the impact of the new 408(b)(2) and 404(a) fee disclosure regulations. Mark also touched on what fiduciary best practices...

Read MoreYear-End Notices for Retirement Plans

There are a series of notices regarding retirement plans that must be provided to participants as the end of 2011 approaches. Included in these notices are the following: 1) If a plan sponsor makes “safe harbor” 401(k) contributions, the plan sponsor must provide the participants with a safe harbor notice...

Read MoreInnovative Speaks in Dallas!

At the Fall 2011 United Benefit Advisors (UBA) Meeting in Dallas, Innovative’s own Mark Sulpizio and Terriann Procida spoke to over 300 members from across the country. Recognized as experts in the retirement plan industry, they discussed the added scrutiny and fiduciary responsibility for retirement plan sponsors, in light of...

Read MoreTibble v. Edison International, A Lesson in Revenue Sharing

When you sponsor a retirement plan you, or someone you appoint, are responsible for making many important decisions associated with the plan such as investment options and service providers. Informed decision making is reliant upon understanding and evaluating the costs associated with the plan. One of the costs inherent in...

Read MoreNotice Published in Federal Register on Lifetime Income Options for Retirement Plans

The Agencies published in the Federal Register a request for information (RFI) regarding whether, and, if so, how, by regulation or otherwise, it would be appropriate for them to enhance the retirement security of participants in employer-sponsored retirement plans and in individual retirement arrangements (IRAs) by facilitating access to, and...

Read MoreIBP sponsors 401(k) Educational Luncheon

Mark Sulpizio, a founding partner at IBP, was the presenter at a qualified plan educational luncheon held at Union Trust Steakhouse in Philadelphia on Thursday, July 22 2010. At the luncheon, Mark reviewed the recently released 408(b)(2) “interim final regulations” from the Department of Labor and how the new rules...

Read MoreFiduciary Update – The SEC and Target Date Branding

As discussed at our recent fiduciary luncheon events, the regulatory agencies are continuing to look at target date funds. Last week, the commissioners at the SEC approved new regulations regarding the marketing of target date funds. The agency wants to require the use of a visual aid illustrating the funds...

Read More5500 Efast Filing

As you may already be aware, new regulations were recently passed requiring all sponsors of qualified plans to file their Form 5500 and accompanying schedules electronically beginning January 1, 2010. Hard copies will no longer be accepted, rather will need to be submitted via the Department of Labor’s EFAST2 electronic...

Read MoreInnovative Sponsors 401(k)/403(b) Fiduciary Luncheon

Mark Sulpizio, a founding partner at IBP, presented a workshop on the added fiduciary responsibilities plan sponsors will face due to the upcoming Department of Labor 408(B)(2) regulations at Ruth’s Chris Steak House in Princeton, NJ. The program reviewed what plan sponsors should be doing to prepare for the regulations...

Read MoreMarch 2010 Retirement Plan Update Part 1

It has been a busy year in Washington with stimulus, cap and trade and health care dominating the headlines. Behind the scenes, it has also been a busy year for proposals that will affect how employers manage their retirement plans. Currently, there is pending legislation in Washington regarding participant level investment advice and the way advisors are compensated...

Read MoreCategories

Archive