IRS Issues 2023 HSA and HRA Limits

The IRS issued Revenue Procedure 2022-24, to announce the 2023 inflation adjusted amounts for health savings accounts (HSAs) under Section 223 of the Internal Revenue Code (Code) and the maximum amount employers may contribute for excepted benefit health reimbursement arrangements (HRAs). Significant increases to the limits are a result of the recent spike in inflation seen in the U.S.

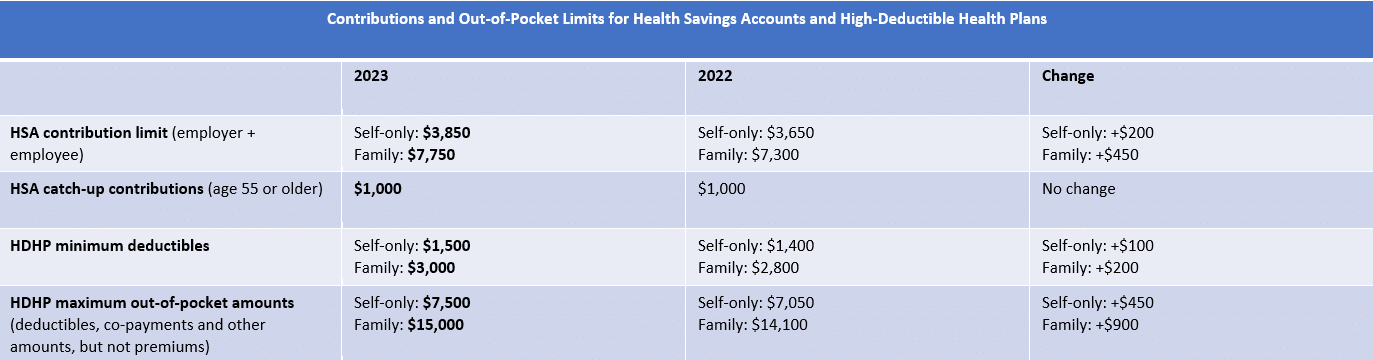

HSA Limits

For calendar year 2023, the HSA annual limitation on deductions for an individual with self-only coverage under a high deductible health plan is $3,850. The 2023 HSA annual limitation on deductions for an individual with family coverage under a high deductible health plan is $7,750. The IRS guidance provides that for calendar year 2023, a “high deductible health plan” is defined as a health plan with an annual deductible that is not less than $1,500 for self-only coverage or $3,000 for family coverage, and the annual out-of-pocket expenses (deductibles, copayments, and other amounts, but not premiums) do not exceed $7,500 for self-only coverage or $15,000 for family coverage.

HRA Limits

For plan years beginning in 2023, the maximum amount employers may contribute to an excepted benefit health reimbursement arrangement or EBHRA is $1,950, up from $1,800 in 2022. This is the first time the EBHRA limit has increased since EBHRAs were introduced in 2020.

To better explain Health Savings Accounts to your employees, check out this informational video.

If you have any questions, please feel free to contact us at icomply@ibpllc.com.

Categories

Archive